(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2014. Click here to read the entire piece.)

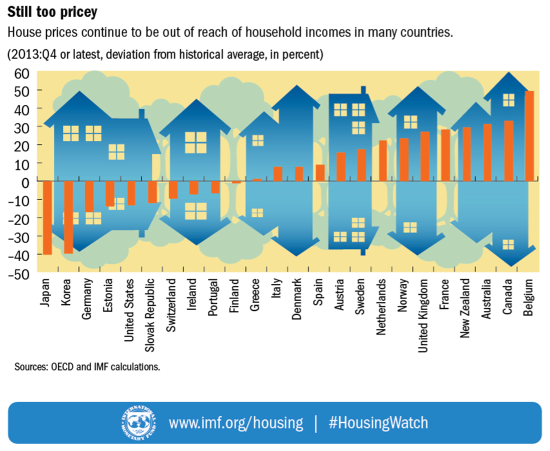

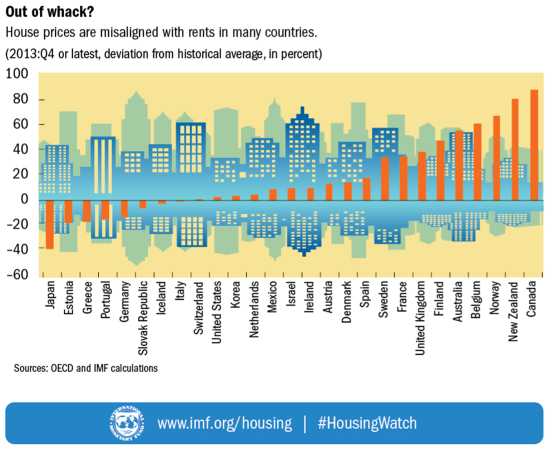

The IMF recently established an informative web site called “Global Housing Watch” that promises to provide quarterly updates on housing conditions around the world. The update for Q4 of 2013 shows that Australia has one of the most expensive housing markets in the world in terms of both price-to-income (third highest among the IMF’s selection of countries) and price-to-rent (fifth most expensive).

Source: IMF Global Housing Watch

These ratios are aggregates across entire countries and cannot speak to the broad range of conditions across local markets within a country. In the case of Australia, Sydney has the most focus…at least from the Reserve Bank of Australia (RBA).

On July 3rd, 2014, Stevens provided an “Economic Update” at The Econometric Society Australasian Meeting and the Australian Conference of Economists at the University of Tasmania. Despite the ominous looking ratios reported above, Stevens and the RBA have concluded that on balance the housing market is generally fine. Moreover, the bank does not see the need to take any action as a specific response to the housing market:

{snip}

Stevens reminded the audience that the RBA has been very consistent on four points regarding Australia’s housing market:

{snip}

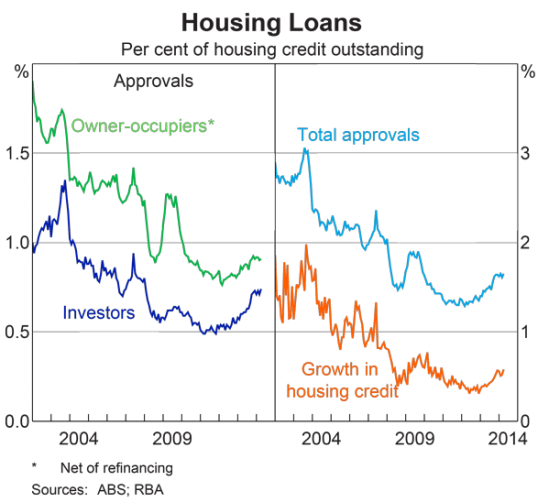

Source: Reserve Bank of Australia

Stevens went on to remind and warn his fellow Australians that housing prices can and do fall. He also admonished banks to maintain strong lending standards. Finally, Stevens took some tentative comfort in the recently slowed growth in housing prices in several Australian metros, including Sydney.

{snip}

Central banks across the globe face the dilemma of over-heating local housing markets embedded within slow-growth economies…

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2014. Click here to read the entire piece.)

Full disclosure: no positions