(This is an excerpt from an article I originally published on Seeking Alpha on June 26, 2014. Click here to read the entire piece.)

Australia’s Bureau of Resources and Energy Economics (BREE) recently released its Resources and Energy quarterly for the June, 2014 quarter containing a notably more cautious tone toward the Australian dollar (FXA) and its interaction with commodity prices (particularly iron ore, Australia’s largest export). Specifically, the stubbornly strong Australian dollar has forced the BREE to hike its forecast of the currency’s exchange rate in subsequent years and to insert the exchange rate as a specific risk factor to its forecasts on export economics.

{snip}

Throughout the March report, the BREE presumed that a lower exchange rate would support exports across Australia’s commodities. Fast-forward three months and the BREE has gone from a 2014-2015 forecast of 0.86 for the Australian dollar versus the U.S. dollar to 0.90 for this period. The catalysts for a lower currency have all disappointed so far. {snip}

{snip}

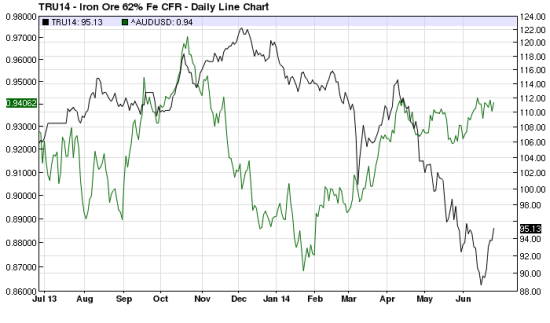

Perhaps most perplexing for the BREE (and me) is that the Australian dollar has fallen alongside iron ore year-to-date. {snip}

Source: barchart

{snip}

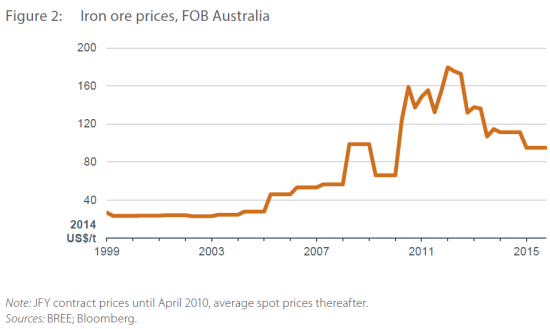

Source: BREE

The drop in iron ore has not prevented Australia from realizing revenue gains from its exports. {snip}

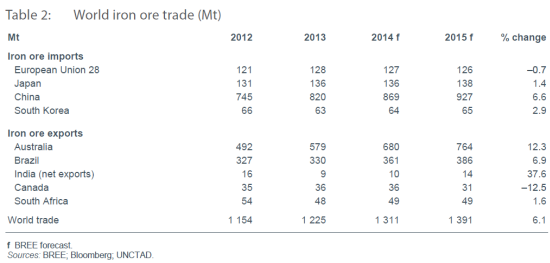

The BREE’s expectations for imports and exports among the major players shows a major surplus. {snip}

Source: BREE

This chart makes me wonder about Rio Tinto’s (RIO) recent claim that China will be ready to absorb Australia’s surging production of iron ore.

Overall, iron ore is helping to maintain a relatively strong forecast for GDP growth in Australia. However, the stubbornly strong Australian dollar is cited as a major risk factor. Instead of the story from the March report of a currency supporting future growth, the Australian dollar has now become a risk factor for growth. {snip}

Next up should be the Reserve Bank of Australia (RBA) using the language of the BREE to put a slightly brighter spotlight on the surprising strength in the Australian dollar. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 26, 2014. Click here to read the entire piece.)

Full disclosure: (marginally) net short Australian dollar