(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2014. Click here to read the entire piece.)

{snip}

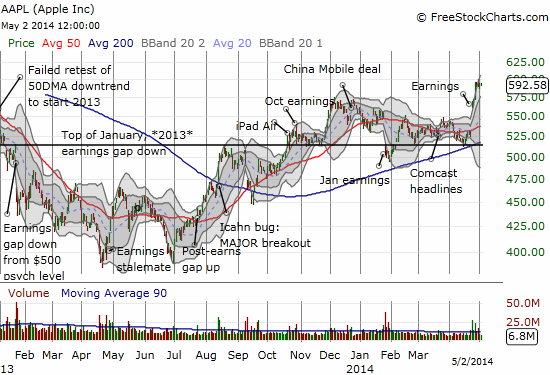

This quote is from a piece I wrote in early March titled “Apple’s Post-Earnings Buyback Fails To Sway Growing Negative Sentiment In The Stock.” At that time, I was wringing my hands over what I believed was a surprising litany of signs pointing toward negative sentiment on Apple (AAPL). {snip}

If institutional investors do not reload, the 7:1 split planned for holders of stock as of the close of trading on June 2nd will help bring more retail investors into the stock…{snip}

{snip}

Source: FreeStockCharts.com

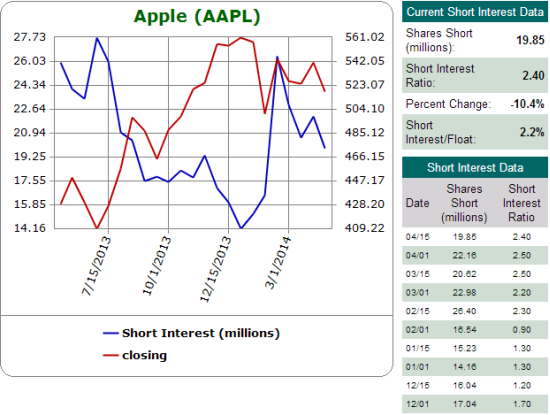

Short interest has turned around dramatically. {snip}

Source: Schaeffer’s Investment Research

{snip}

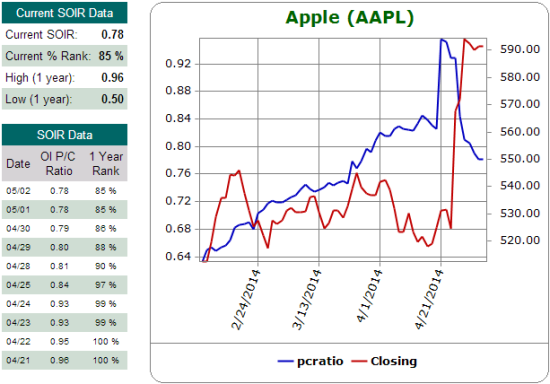

Options trading seems to support an interpretation of a retreat in bearishness. {snip}

Source: Schaeffer’s Investment Research

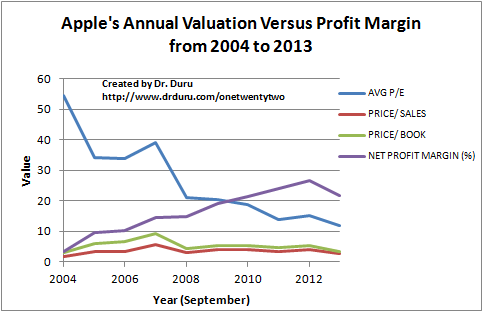

These signals provide an illuminating backdrop for the fundamental reasons traders and investors might place stronger hopes on Apple: major changes to the company’s “capital return program” and valuation.

{snip}

Source: MSN Money

According to MSN Money, the current valuations are as follows: 14.8 P/E, 12.1 Forward P/E, 3.1 Price/Sales, 3.9 Price/Book. Using $10.2B in net profit and $45.6B in revenue I come up with a 22.3% net profit margin for the previous quarter. A small adjustment higher in willingness to pay for AAPL from improving sentiment should easily send the stock back to all-time highs.

Overall, the tide seems to be finally turning for AAPL. Improving trader and investor sentiment sits at the core of the recovery story in the shares. Next up, new products to seal the deal…?

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2014. Click here to read the entire piece.)

Full disclosure: long AAPL shares and call options