(This is an excerpt from an article I originally published on Seeking Alpha on March 20, 2014. Click here to read the entire piece.)

{snip}

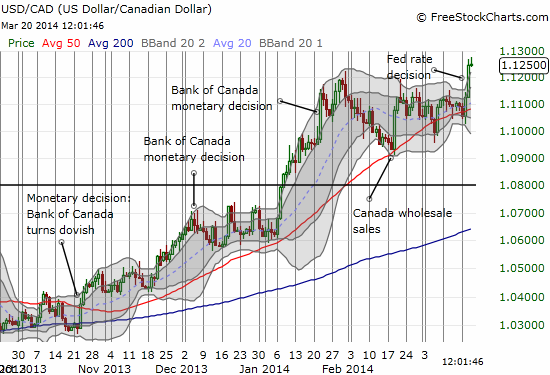

This is from Janet Yellen’s first Federal Reserve press conference as Fed Chair (starting around the 37:00 mark). Yellen answered a question from a reporter from Reuters on when rates would start increasing after QE has ended this Fall. On the whole, this statement is just as innocuous as as any of the many statements made during the press conference. It is purposely imprecise and full of conditions and caveats. However, it appears the market in trigger-happy form interpreted Yellen’s timetable too literally. I believe expectations for the first Fed rate hike are for mid to late-2015. Yellen’s “six months or that type of thing” target could be interpreted as delivering a first rate hike as early as the Spring of 2015. The adjustment in expectations helped send the U.S. dollar index (UUP) soaring off its recent bottom.

{snip}

Source of charts: FreeStockCharts.com

{snip}

Interestingly, Yellen appeared to walk reporters away from thinking rate expectations were going higher faster right at the beginning of the press conference. Wall Street Journal’s Jon Hilsenrath asked the second question in the press conference with an observation on the apparent “upward drift” in forecasts by Committee members for interest rates going out to 2016. {snip}

(This is an excerpt from an article I originally published on Seeking Alpha on March 20, 2014. Click here to read the entire piece.)

Be careful out there!

Full disclosure: net long U.S. dollar