(This is an excerpt from an article I originally published on Seeking Alpha on January 24, 2014. Click here to read the entire piece.)

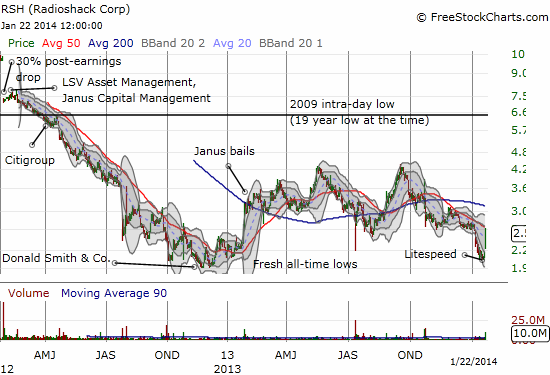

On January 17, 2014, Litespeed Master Fund, Ltd. filed a Form SC 13G (statement of acquisition of beneficial ownership by individuals) with the SEC announcing a purchase of 8,080,695 shares in Radioshack (RSH) equating to an 8.1% stake in the company. The stock popped 5.8% the next trading day (January 21) and really got motoring the next day with a 17.6% gain. While it was strange to see such a delay in the really big move, it is perhaps understandable given RSH’s steep decline in value over the years. The chart below highlights other major purchases since RSH dropped 30% on January 31, 2012 to $7.18 in reaction to one of a coming series of poor earnings reports.

Source: FreeStockCharts.com

{snip}

The big winner in the bottom-fishing contest was, and still is, Donald Smith & Co., “a registered investment adviser specializing in managing value equity accounts for tax-exempt and taxable funds, and high net worth individuals.” {snip}

If history repeats itself, the delayed response to Litespeed’s announcement may get partially or nearly completely reversed in due time. This delay-rally-reversal-rally pattern occurred after Donald Smith & Co.’s announcement. A pullback from the latest sharp rally could mark the last great buying opportunity in RSH for a while – again, if history repeats itself. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 24, 2014. Click here to read the entire piece.)

Full disclosure: no positions