(This is an excerpt from an article I originally published on Seeking Alpha on Feb 10, 2014. Click here to read the entire piece.)

The U.S. non-farm labor report for January, 2014 seemed to get universal disapproval. Yet, the stock market soared in response anyway. The bearish tidings that began last week week have almost evaporated as rapidly as they arrived.

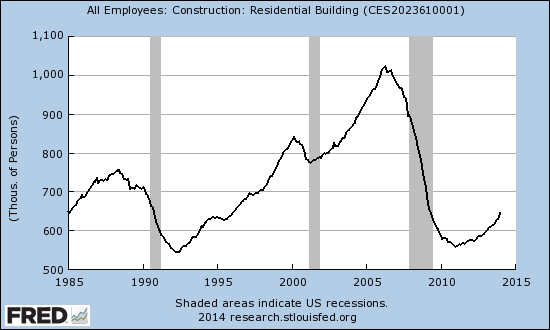

Perhaps it is possible that a sufficient number of market participants were more focused on the positives in the report than a miss on “expectations” which are always subject to plenty of error. From my own interest in particular, I took note of two things: the continued momentum for jobs in residential construction and the ability of the unemployment rate to remain stable despite an increase in the participation rate.

Seasonally adjusted jobs in residential construction increased from 633.4K in December, 2013 to 646.6K in January, 2014. {snip}

Source: St. Louis Federal Reserve

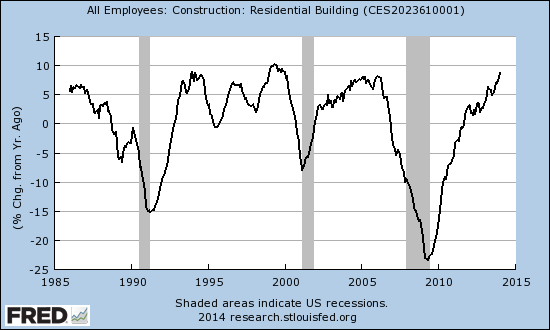

{snip}…I think it makes more sense to say that housing industry may finally have reached a self-sustained momentum, a kind of “escape velocity” from the doldrums of the previous depression in housing.

Source: St. Louis Federal Reserve

{snip}

The second item of note for me in the latest jobs report was the marginal increase in the labor participation rate. {snip}

Back in September, I discussed interesting research by staff economist Andreas Hornstein at the Federal Reserve Bank of Richmond that challenged the conventional thinking on the relationship between the participation rate and the unemployment rate. Hornstein concluded that the unemployment rate will not increase if non-participants return to a strengthening labor market. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on Feb 10, 2014. Click here to read the entire piece.)

Full disclosure: no positions