(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2014. Click here to read the entire piece.)

{snip}

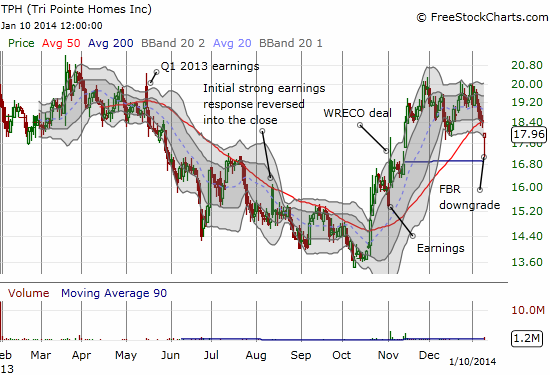

And so it seems an analyst at FBR is longing for those days when TPH could be bought at an attractive discount. FBR downgraded the stock from buy to neutral and reduced its price target from $21 to $19. Here is the rationale as posted on Seeking Alpha (emphasis mine):

“We believe the growth potential of TRI Pointe’s (TPH) WRECO acquisition is being reflected at current valuation that is on the higher end of the group.” …Stelmach continues to be a fan of the company thanks to its California exposure, the WRECO acquisition, ample dry powder from a large land portfolio, and a seasoned management team. He’s just looking for a more favorable entry point.”

{snip}

Source: FreeStockCharts.com

Downgrades that are a part of a request to the market to deliver a better entry point always intrigue me. In this case, the investment thesis for TPH has not changed at all. {snip}

Unlike TOL and LEN, shorts have continued to soar against TPH. {snip} Clearly, there are plenty of traders betting on lower entry points.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2014. Click here to read the entire piece.)

Full disclosure: long TPH