(This is an excerpt from an article I originally published on Seeking Alpha on January 8, 2014. Click here to read the entire piece.)

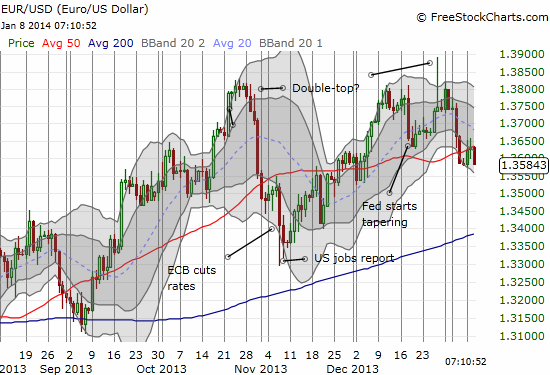

Weakness continues for the euro (FXE) as 2014 seems to be confirming expectations I have outlined in previous posts.

On January 7th, Eurostat reported eurozone inflation dropped to 0.8% in December on an annual basis. This further supports the earlier decision by the European Central Bank (ECB) to finally cut interest rates again back in November. However, the euro remains higher than that point in trade versus the U.S. dollar.

Source: FreeStockCharts.com

{snip}

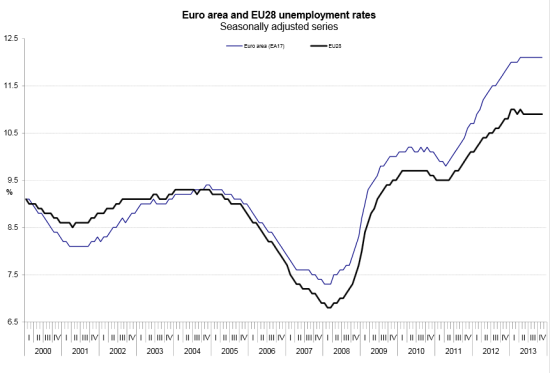

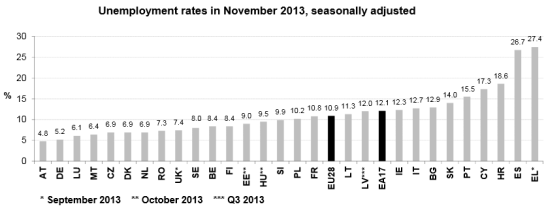

In November, unemployment remained steady for the eighth month in a row at 12.1%. This steady-state could be looked at as progress for the glass half-full crowd since conditions are not worsening. However, this unemployment rate is still a record. Moreover, this lack of progress stands in stark contrast to the steadily improving conditions in the United Kingdom and the U.S. This contrast remains a core rationale for my expectation of a lower euro to start the year.

Source: Eurostat

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 8, 2014. Click here to read the entire piece.)

Full disclosure: net short euro