(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2013. Click here to read the entire piece.)

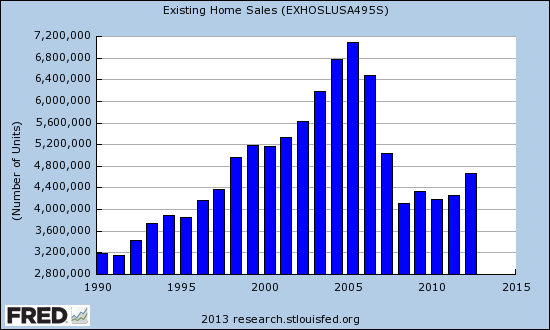

On Monday (November 25, 2013) the National Association of Realtors (NAR) reported a fifth straight month of declining pending home sales. NAR chief economist Lawrence Yun projects that 2013 will end with existing home sales 10% above 2012, so the current monthly declines represent a cooling off from near over-heated conditions earlier in the year. Yun expects 2014 will be flat with 2013. The projected annual sales pace of 5 million units still only gets the housing market back to levels last seen in 1998.

Source: St. Louis Federal Reserve

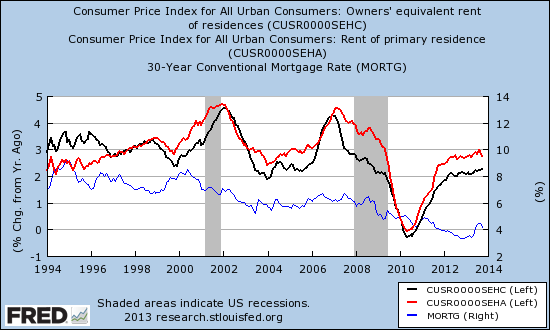

In the short video accompanying the release, Yun also commented on his expectations for interest rates. Up until now, I had not heard these assessments. Yun believes long-term interest rates, and thus mortgage rates, are headed up next year no matter what the Federal Reserve does with tapering. He referenced the rise in renters’ rent and homeowners’ equivalent rent, the largest components of the Consumer Price Index (CPI). At their current pace, these measures may generate inflationary pressures next year, especially if another component flashes red as well. {snip}

Source: St. Louis Federal Reserve

{snip}

It IS notable that the current near 4-year rise in rents has no parallel in the last 20 years. {snip} Of course, the rise will be seen as anticipation of tapering. Since tapering will only arrive in the context of a sustained recovery, the logic for higher rates gets a neat, self-reinforcing loop.

Yun does not think higher rates will end the housing recovery. {snip}

{snip}

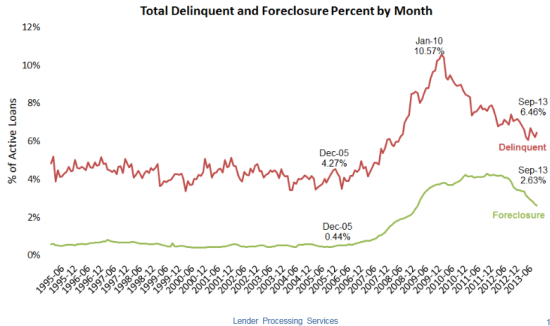

Source: Lender Processing Services

Overall, 2014 still looks like a pivotal year for the housing recovery. Rising pent-up demand for housing, easing credit conditions, and higher rates will combine into some kind of volatile mix. I will continue to treat negative responses to poor data during this period as potential opportunities to add to my participation in the housing recovery at better prices.

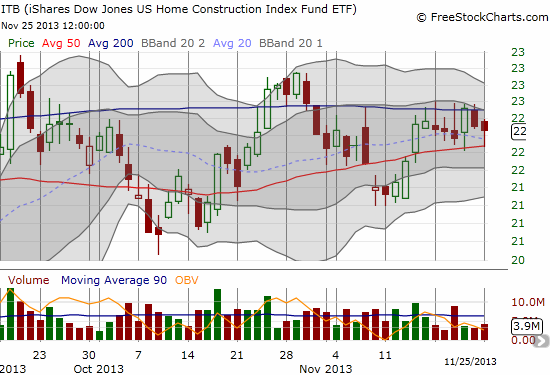

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2013. Click here to read the entire piece.)

Full disclosure: no positions

Embed