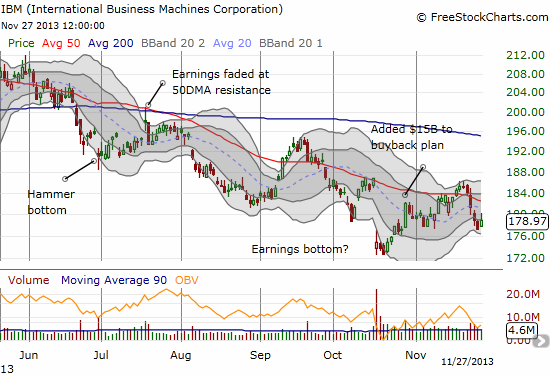

A week ago, I wrote “Simple Reasons to Like IBM Despite the Headwinds.” As I feared/suspected at the time, sellers stepped in at an important resistance level. In four quick days, International Business Machines (IBM) dropped like a rock and retested presumed support from the announced expansion of the buyback.

I thought I would have to buy back IBM into strength. I greatly prefer buying the dip and seized on the opportunity to take another swing at support. The near 1% bounce today (Wednesday, Nov 27, 2013) appears to validate my timing but the fade from the highs present a yellow caution signal. I purchased call options to give me an automatic stop-loss in case IBM breaks down further.

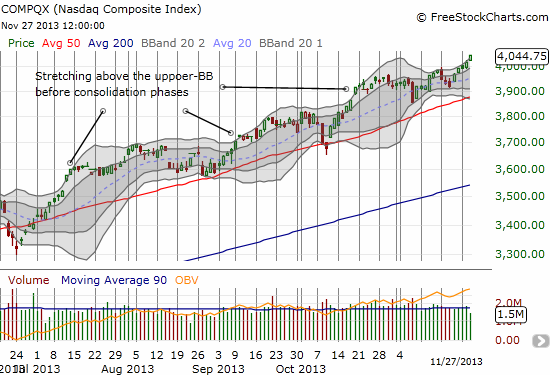

For now, the NASDAQ is likely providing a nice tailwind for the strategy of using IBM as a way to buy into the rally “on the cheap.” Today, the tech-laden index flipped into overdrive hitting a fresh 13-year high, closing well above its upper Bollinger Band (BB). As in previous such episodes – Oct 18th, Sep 10th, and Jul 11-12th – the index is likely to cool off into a brief consolidation phase before resuming the upward momentum (see my analysis of Black Friday trading for additional cues).

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long IBM calls