(This is an excerpt from an article I originally published on Seeking Alpha on November 4, 2013. Click here to read the entire piece.)

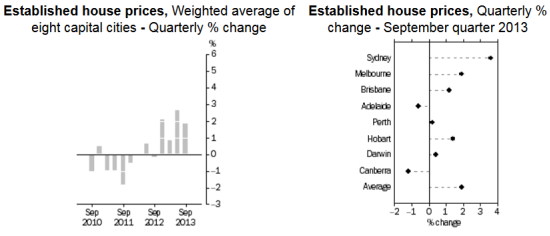

The Australian Bureau of Statistics (ABS) latest report on housing prices in Australia’s eight capital cities demonstrates a market that remains hot, especially in Sydney. These increasing prices are no surprise given the Reserve Bank of Australia’s round of rate cuts earlier this year. {snip}

Source: Australian Bureau of Statistics

On an annual basis city-by-city, house prices rose as follows: Sydney (+11.4%), Perth (+8.6%), Melbourne (+6.8%), Darwin (+6.0%), Brisbane (+4.1%), Hobart (+1.1%), Adelaide (+1.0%) and Canberra (+0.6%).

{snip}

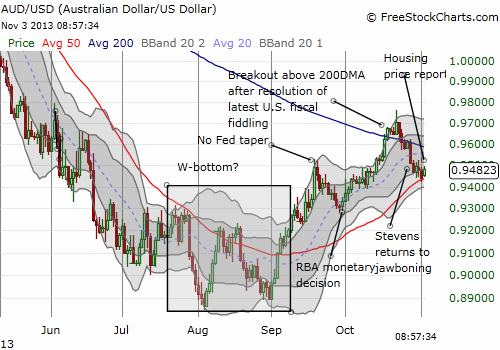

Source: FreeStockCharts.com

The RBA provides its next rate decision on Tuesday morning (Australian time). This meeting will be a first good test of whether the RBA will directly back up the recent jawboning of Governor Stevens. I will also look to see whether the RBA acknowledges that the heating of the Australian housing market will impact its approach to monetary policy in the coming quarters.

(This is an excerpt from an article I originally published on Seeking Alpha on November 4, 2013. Click here to read the entire piece.)

Full disclosure: long Australian dollar