(This is an excerpt from an article I originally published on Seeking Alpha on October 29, 2013. Click here to read the entire piece.)

{snip}

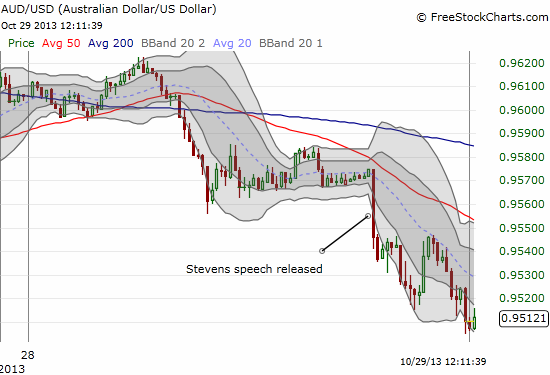

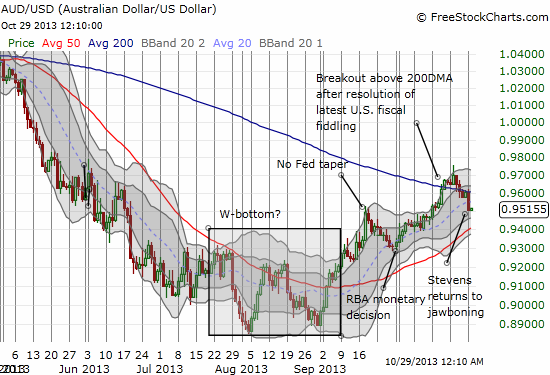

And with that Governor Stevens went back on “attack” on the Australian dollar (FXA). This is the exact jawboning I had been expecting earlier to replace the RBA’s surprising omission that inflation gives the RBA scope to cut rates further. He could not be any more clear or direct on projecting the ultimate (medium-term) direction of the Australian dollar and why it should go much lower.

I was clearly a bit pre-mature a few days ago in calling the recent dip in the Australian dollar a buying opportunity. My nascent and budding confidence came from a firm inflation (CPI) print last week and the lack of jawboning in Stevens’ prior speaking appearance (at the Australian British Chamber of Commerce) on October 18th. {snip}

{snip}

Source: FreeStockCharts.com

Stevens added pressure to the Australian dollar by reminding investors and traders that tapering by the Federal Reserve will eventually come…and its impact will likely be similar to the last episode of taper fears.

{snip}

The devaluation playbook for the RBA seems clearer now: 1) hope the Fed’s tapering comes sooner rather than later; 2) restart a campaign to remind markets that the Australian dollar has no business trading as high as it is. The markets are often stubborn, forcing financial authorities to move from words to action. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 29, 2013. Click here to read the entire piece.)

Full disclosure: long Australian dollar