(This is an excerpt from an article I originally published on Seeking Alpha on October 20, 2013. Click here to read the entire piece.)

This post rides piggyback on a recent Seeking Alpha Market Current quoting concerns from Art Cashin (formerly featured on CNBC) regarding “a bubble in cloud/mobile tech names” and is a follow-up from an early September post I wrote titled “Valuation Update: Internet High-Fliers Experience Large Mark-Ups.”

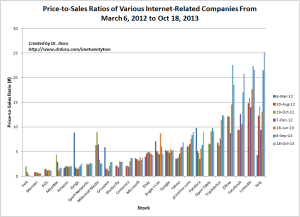

The reference to valuations caught my attention because I have done periodic posts showing the relative rankings of various internet-related names using the price-to-sales ratio. I do not use price-to-earnings because some of the companies do not have positive earnings. Price-to-book is slippery given most of these companies have their strength in intellectual and virtual capital that does not get accounted well in book valuations. A snippet from the SA Market Current:

{snip}

{snip}

Click image to enlarge…

{snip}

Google (GOOG) just reported earnings that the market loved, resulting in a spectacular 14% pop above the $1000 barrier. {snip}

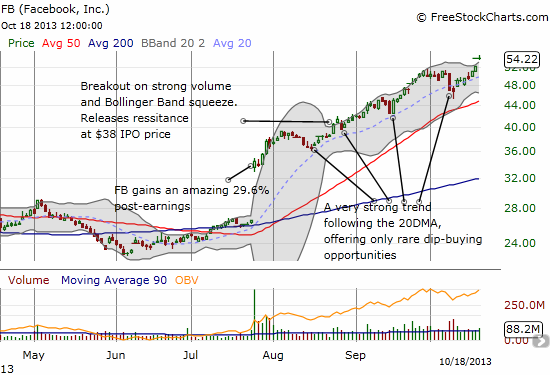

A special note on FB since I laid out a trading strategy after its post-earnings pop in July. {snip}

GOOG’s earnings pop sent FB jumping to a fresh all-time high at $54.22. I sold my last bundle of call options into that pop for yet another fantastic return…{snip}

FB earnings are coming up October 30th, and I fully expect the stock to have plenty of heft running into those earnings. {snip}

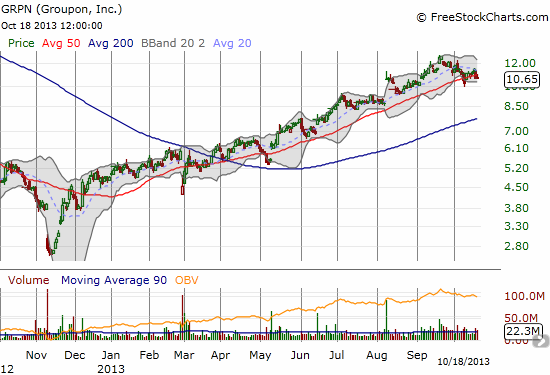

Finally, a quick note on Groupon (GRPN). {snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 20, 2013. Click here to read the entire piece.)

Full disclosure: long MM, YHOO, ZNGA, MWW; short FB; long P puts