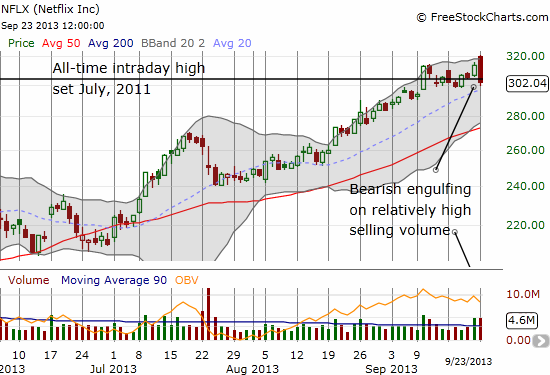

Netflix (NFLX) has been on a wild ride as sentiment about the company’s business has swung from extremes of optimism to pessimism and back again. I have been keeping a casual eye on the stock for any signs of the next change. Today, September 23, may have delivered that change. On high selling volume, NFLX retreated from all-time highs with a bearish engulfing pattern:

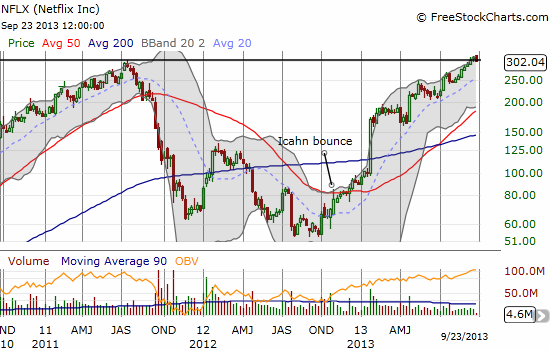

Mind you – this technical call is no slam dunk. NFLX has had a stellar year with multiple up gaps and now a very smooth uptrend since the July lows. It has been a remarkable turn-around from an ugly close to 2011 and a 2012 which broke 2011’s low after a fake-out rally earlier in the year. Netflix’s bottom was essentially secured by a timely investment by Carl Icahn in November, 2012.

Source for charts: FreeStockCharts.com

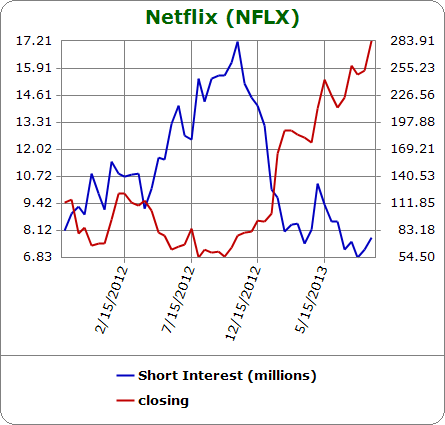

Adding to the drama in Netflix are dramatic changes in short interest and options trading. While short interest is still 18.3% of float, shares short have plunged in what looks like a mass evacuation since around the time Icahn moved into the neighborhood. So, it is not clear whether Icahn had great timing or whether shorts who fear Icahn have helped squeeze Netflix skyward. Either way, the change in short interest is huge, a roughly 60% decline.

Source: Schaeffer Investment Research

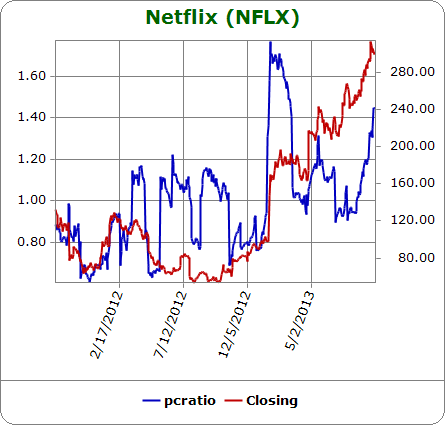

While short interest has plunged, the interest in puts has ebbed and waned. Sharp rallies in NFLX have invited some reflex put buying from disbelievers. The most intriguing pattern has occurred since August. Since then, the open interest put/call ratio has risen just as smoothly as the stock has. It is not easy to interpret this action given NFLX holders may simply be accumulating protective puts. If that is the case, NFLX is not likely to drop much until the put/call ratio drops: lacking protection, holders would be more likely to sell. It is also possible that bears are regrouping, choosing puts instead of short positions to avoid getting caught in another massive squeeze. If this is the case, selecting moments like these with bearish technical signals provide a good opportunity to bet against the stock. Time should soon tell which signal is at work.

Source: Schaeffer Investment Research

At some point, investors who have captured these nice profits in NFLX will sell. Even Icahn must be licking his chops by now with NFLX’s valuation back to the sky high levels of 90 forward P/E, 4.7x sales, and 16.7x book. Trailing P/E is 376. I think it is safe to say the minute word gets out Icahn is selling, NFLX will plunge like a rock. This likelihood alone should motivate Icahn to completely liquidate once he does sell. In the meantime, insiders are happily unloading stock into these stratospheric levels. Officers and directors have been unloading hundreds of millions of dollars in stock all year, mostly through automatic dumping programs. It seems to me it is only a matter of time before the last enthusiastic buyer buys his/her last share for this cycle.

If NFLX confirms the bearish engulfing topping pattern with more selling, especially on high volume, I will take such bearish confirmation as my signal to give some puts a try.

Be careful out there!

Full disclosure: no positions