(This is an excerpt from an article I originally published on Seeking Alpha on September 15, 2013. Click here to read the entire piece.)

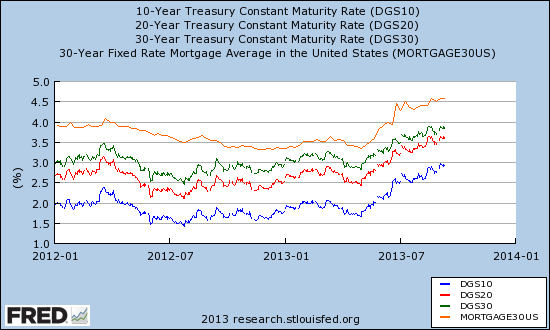

As markets worldwide await the Federal Reserve’s meeting September 17-18th, I imagine that housing will play a major role in the decision-making for monetary policy. Interest rates have risen sharply in anticipation of some kind of pullback in the Fed’s bond buying.

Source: St. Louis Federal Reserve

At the same time, housing prices have soared by any measure out there. Some have claimed a new housing bubble is underway. An appreciation of the diverse conditions in the housing market present a much more nuanced picture. {snip}

Putting this altogether, Kolko concludes that the housing market is not likely headed into a bubble anytime soon:

{snip}

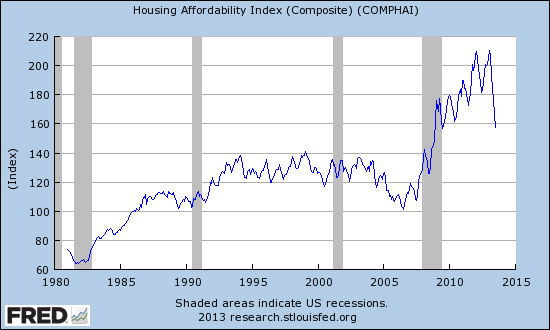

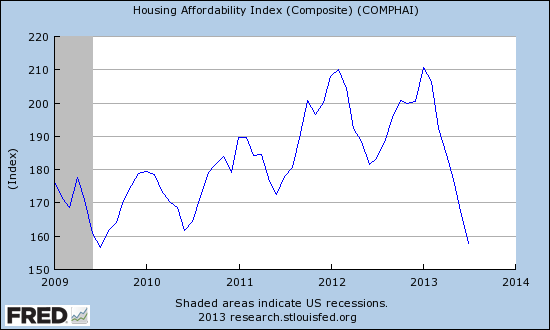

I think the talk of a bubble overly focuses on the hottest housing markets which, appropriately enough, have some of the strongest job markets in the country. I think what is likely most unsettling is the rapid pace at which housing affordability has plunged. {snip}

Source: St. Louis Federal Reserve

Source: St. Louis Federal Reserve

Affordability is nowhere as bad as it was during the last bubble or even the over-heated market of the late 1990s. Yet, plunging back to levels last seen since the economy emerged from recession is certainly bad for market psychology. Moreover, rapid changes in rate can have very similar effects to hitting some psychologically important absolute level. {snip}

The Federal Reserve slips into this volatile cocktail as it purportedly prepares to pull back on the bond buying that is supposedly helping to prop up the housing market. {snip}

{snip} Assuming the Fed believes its actions have directly helped the housing market, it can only conclude that doing anything that helps drives mortgage rates up even further could cause a renewed slowdown in housing activity. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 15, 2013. Click here to read the entire piece.)

Full disclosure: net long the U.S. dollar, long SSO calls, long TBT, and long various housing-related stocks such as TPH, UCP, and GFA.