(This is an excerpt from an article I originally published on Seeking Alpha on September 12, 2013. Click here to read the entire piece.)

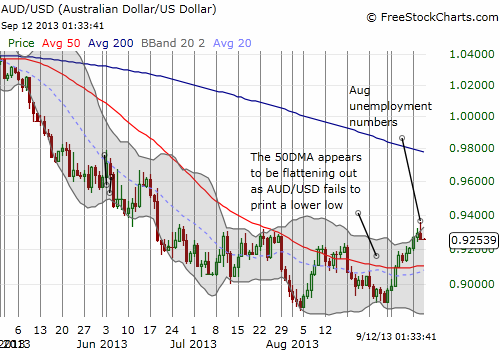

Financial markets must have had extremely optimistic expectations for Australia’s August employment numbers. Right after the release of the employment statistics on September 12th (Australian time), the Australian dollar (FXA) pulled back sharply across the board.

Source: FreeStockCharts.com

{snip}

I will now watch more closely the change in expectations for a rate cut in October. Ever since the last statement on monetary policy on September 4, the Reserve Bank of Australia (RBA) Rate Indicator has been driving toward near certainty for no change in rates:

{snip}

These expectations have been at least partially responsible for driving the current relief rally on the Australian dollar.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 12, 2013. Click here to read the entire piece.)

Full disclosure: net long Australian dollar