(This is an excerpt from an article I originally published on Seeking Alpha on June 3, 2013. Click here to read the entire piece.)

Average, median, frequency, and context. These are all measures to take into consideration when assessing the odds of an event and its potential impact. It is something almost always lost in the discussion of “sell in May.”

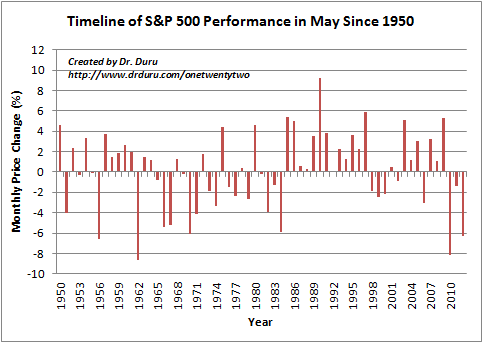

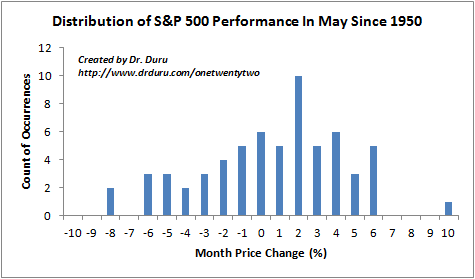

In “This Month Of May Is Not Likely To Hurt – Just In Case, Some Hedging Ideas“, I noted how rare it is since 1950 for the S&P 500 (SPY) to finish May with a loss three years in a row. {snip}

Source for price data: Yahoo!Finance

{snip}

Now that summer has begun, it is natural to think that the summer must then be the time to sell. I covered the odds for summer, including its relationship to May performance, in a 2011 piece called “Summer’s Positive Gains Can Come With High Risks.” {snip} Given that May was an up month, the odds strongly favor an up summer by an almost 2:1 margin. Since 1950, when the S&P 500 closed May in positive territory, the summer finished in positive territory 23 times and finished in negative territory 12 times. I like to interpret the overall results for summer as meaning that it makes sense to buy the dips in the summer, especially the big ones.

{snip}

Source: The Atlantic

Caterpillar (CAT)

{snip}

Ranger Equity Bear ETF (HDGE)

HDGE continued its tradition of performing very poorly when the S&P 500 performs well (like a leveraged ETF). {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 3, 2013. Click here to read the entire piece.)

Full disclosure: long SSO puts, short euro, long EPV, long CAT shares and puts, long HDGE