(This is an excerpt from an article I originally published on Seeking Alpha on July 14, 2013. Click here to read the entire piece.)

{snip}

I do not follow TheStreet.com’s Jim Cramer as closely as I did many years ago, but every now and then something pops up that manages to catch my interest. The above quote is from a piece where Cramer basically put the entire burden of the economic recovery and the stock market rally on the collective back of housing. This assessment is surprising n several levels after looking closely at the data.

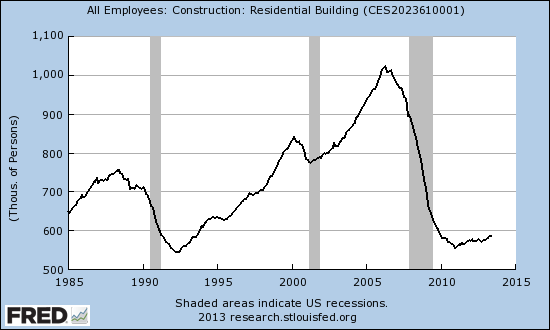

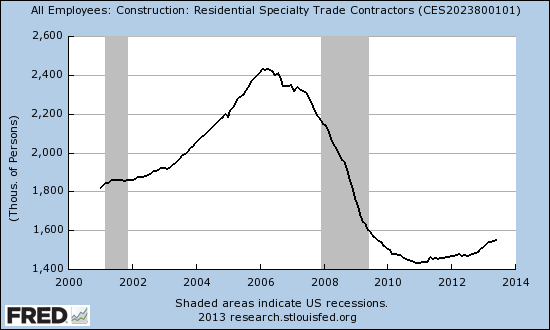

First of all, national employment in residential construction is still at depressed levels. A LOT of upside potential remains here.

Source: St. Louis Federal Reserve

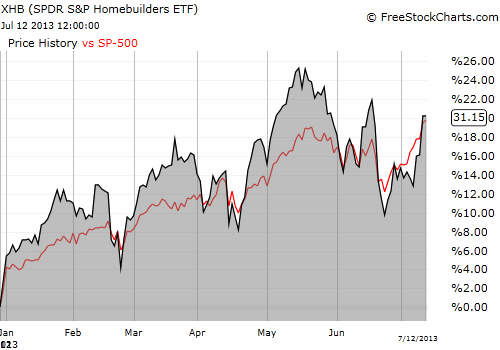

I agree with Cramer about the impact of poor housing-related numbers. The recovery is just getting started after lagging the post-recession recovery for about two years. The recent sell-off in housing-related stocks was a palpable fallout from the recent spike in mortgage rates. However, homebuilder stocks have NOT fully recovered from the “May 22 downturn.”

{snip}

The following list shows how poorly homebuilder stocks have fared since May 22nd. {snip}

ALL the homebuilders are severely lagging the S&P 500 since May 22nd; the S&P 500 is at all-time highs and 1.5% above its May 22nd close. Only 2 of these homebuilders bottomed when the S&P 500 bottomed. The rest have only bounced off lows in the previous week. {snip}

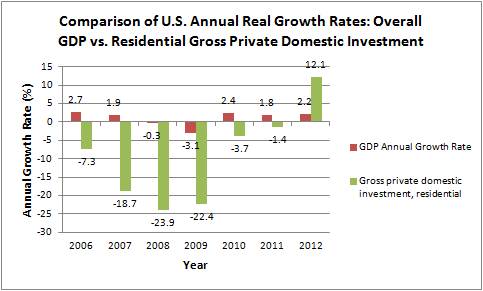

Finally, calling housing a “linchpin” of the recovery is a bit premature. {snip}

The biggest contributor to GDP is of course personal expenditures. Spending on furnishings and durable household equipment is only a very small portion of these expenditures. {snip}

The quarterly and annualized double-digit growth rates in residential gross private domestic investment have only contributed a small part to the overall GDP growth rate. {snip}

{snip} I still plan to use “worrying episodes” as opportunities to increase exposure to homebuilder stocks at lower prices. Cramer is right to worry, but the worries are misplaced given they seem to be coming from an over-optimistic perch.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 14, 2013. Click here to read the entire piece.)

Full disclosure: long TPH