This chart review includes a follow-up from last week’s chart review of International Business Machines (IBM) and SolarCity (SCTY).

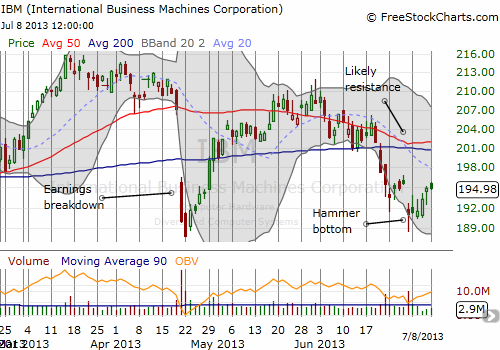

International Business Machines (IBM)

The potential hammer bottom I identified last week got follow-through, but it was too messy to trade. It took two days for IBM to close at a higher price than the high of the day with the hammer. In between was a lot of churn and chop. The stock has now filled a gap and has to deal with resistance from a declining 20-day moving average (DMA) overhead.

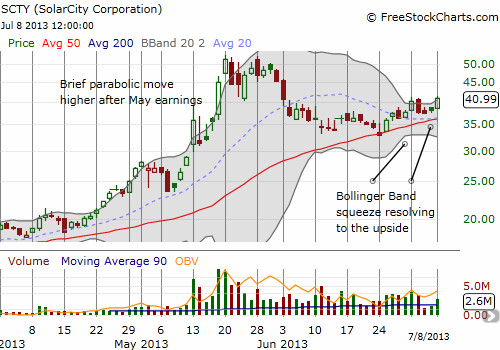

SolarCity (SCTY)

SCTY seems to be resolving its Bollinger Band (BB) squeeze to the upside. The stock has churned a lot, but it has maintained close 20DMA and 50DMA support. Moreover, today’s 7.6% surge came on relatively strong buying volume. I bought calls last week as it appeared the explosive move from the BB squeeze would resolve upward. Note how the BBs are opening outward now; it is like an invitation for the stock to streak along the upper-BB.

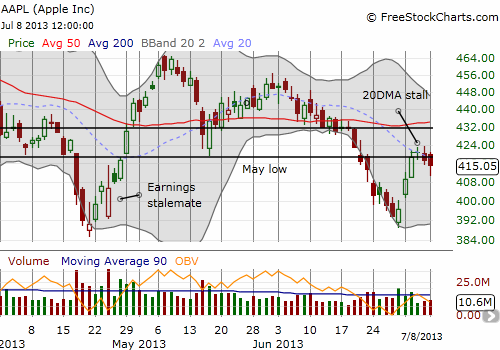

Apple (AAPL)

AAPL has run straight into stiff resistance at the combination of the May low and a declining 20DMA. Today was the second day in a row of underperformance for AAPL, so the bearish warnings are slightly increasing. However, volume was very light today. Note that today’s decline is a departure from AAPL’s typical strong opening to the week (the dash upward of 4 points or so right after the open does not quite count!).

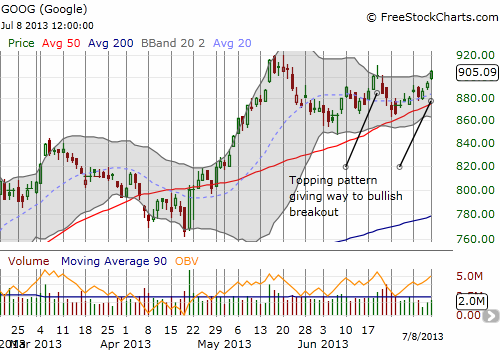

Google (GOOG)

Google continues to shine and provides a stark contrast to Apple’s on-going struggles. Perhaps investors are slowly but surely draining money from AAPL and planting it in GOOG. GOOG is holding support at the 50DMA and looks set to break out again. (The current pattern almost looks like a classic cup and handle). I have not yet purchased another round of GOOG calls after last Friday’s success. I prefer to wait for dips, especially close to support. If the current streak continues, the market may only grant very shallow (intraday) dips.

Be careful out there!

Full disclosure: long SCTY calls; AAPL shares, calls, and puts