(This is an excerpt from an article I originally published on Seeking Alpha on May 21, 2013. Click here to read the entire piece.)

{snip}

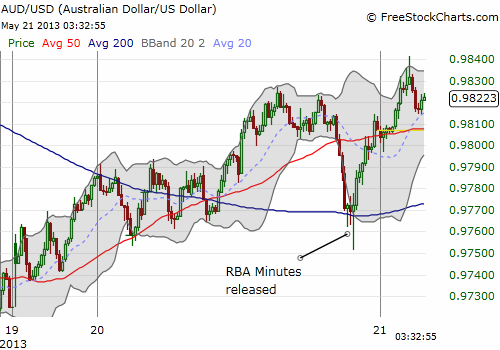

In Monday’s minutes (Tuesday Australia time) of the May 7th policy meeting, the RBA provided no direct smoking gun to explain what I called at the time a mystifying rate cut. The minutes begin on a relatively optimistic note on expected economic growth rates:

{snip}

However, the minutes DO contain important references to the high exchange rate. It is like a not so subliminal message encouraging traders to sell the Australian dollar (FXA) short:

{snip}

The budding theme seems to say that the high exchange rate is depressing business sentiment and activity. Given Australia’s domestic economic issues revolve around business activity (emphasis mine)…

{snip}

…it stands to reason that the “scope to ease rates” which the RBA uses as license for cutting rates is really about trying to push the exchange rate down.

{snip}

{snip}

The current slide in AUD/USD just happens to correspond with the beginning of trading on April 10th in the Australian dollar against the Chinese RMB. On that day, the Australian dollar printed a false breakout from a downtrend that has been in place since the historic highs in 2011. Could it be after an initial rush of enthusiasm, traders on the Chinese exchange started selling Aussie as hedges on Chinese steel production, exports, etc…? Also on the technical side, AUD/USD is rapidly approaching a retest of last year’s low.

{snip}

Finally, iron ore prices continue to slide. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 21, 2013. Click here to read the entire piece.)

Full disclosure: net short Australian dollar