(This is an excerpt from an article I originally published on Seeking Alpha on June 2, 2013. Click here to read the entire piece.)

{snip}

…Iron prices have plunged almost as severely as they did last August as steel rebar prices have fallen. From Reuters on May 31st:

{snip}

These price declines would seem to be easy recipes for more rate cuts from the RBA. However this time around we have the oddity of Chinese steel production roaring at exceptionally high levels. {snip}

Regardless, if steel production continues at its robust pace, it should soon force a fresh restocking cycle that should in turn put a floor under iron ore prices. The RBA will have to determine (guess?) whether this strength in production will/can actually continue. {snip}

Last year’s plunge in iron ore prices made it clear that the RBA does not have a hot panic button tied to iron ore. {snip}

Under the current rate-cutting cycle, the RBA has given itself license to cut under the rubric of “scope” to ease policy. {snip}

Source: Brisbane Times

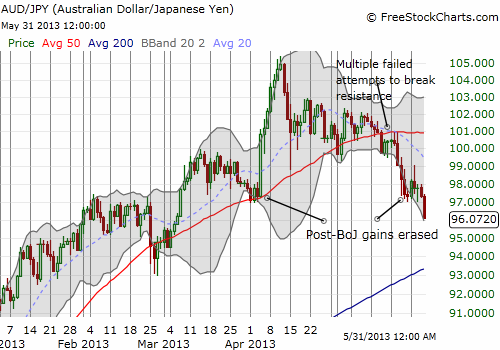

Source: FreeStockCharts.com

Language in the next statement that confirms the RBA is still in an accomodative stance will likely punch the Australian dollar even lower. Paired with another rate cut, the skids should stay well-greased. {snip}

Source: FreeStockCharts.com

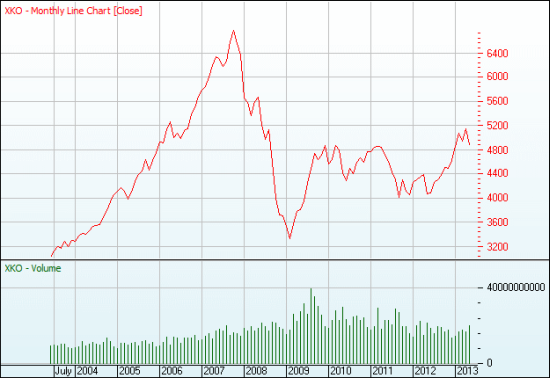

The Australian stock market (EWA) also gives the RBA scope for lowering rates. Unlike the S&P 500 (SPY), the Australian stock market is nowhere near surpassing its all-time high.

Source: Australian Securities Exchange

Instead of rallying over the past month like the S&P 500, the Australian stock market lost significant ground; it lost over 4%. {snip}

Source: Australian Securities Exchange

{snip}

I am also sticking by my longer-term bet on iron ore prices with January call options on Cliffs Natural Resources (CLF), just about the worst dog in the bunch given its high operating costs. Like Morgan Stanley (MS), I will get much more aggressive on iron ore plays if (when?) prices drop to $100 and lower. Unlike previous commodity price declines and crashes, I am much less optimistic about the pace of future rebounds. I think it is time to expect much more modest upside scenarios for perhaps the next two or three years. In the coming weeks, I will post more of my thoughts on this assessment.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 2, 2013. Click here to read the entire piece.)

Full disclosure: net long Australian dollar, long CLF call options