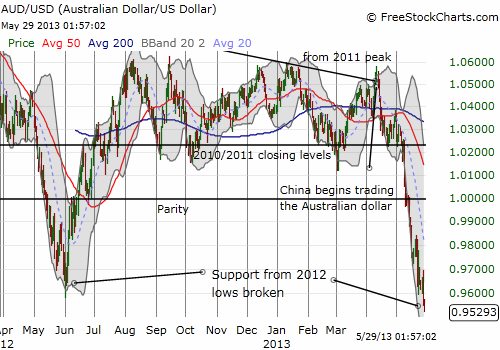

When I last wrote about the Australian dollar (FXA), I targeted a retest of the 2012 low as one of two points to exit my short position on AUD/USD. The test at 0.96 happened last Thursday, May 24, and as AUD/USD printed an obligatory bounce from that support, I exited.

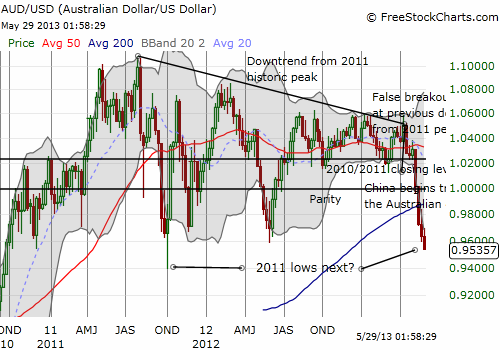

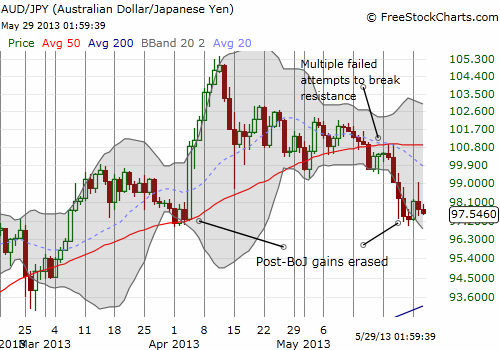

The support held firm until Tuesday, May 28th. AUD/USD took a sudden plunge below the 0.96 level during the Asian trading session. This breakdown is roughly accompanied by the Australian dollar becoming the first major currency to completely erase all its gains against the Japanese yen after the Bank of Japan (BoJ) announced its aggressive monetary policy in April.

The charts below say it all:

Source: FreeStockCharts.com

The Australian dollar remains in a very bearish position, but I am now shading toward long positions in anticipation of a relief bounce. I maintain sell limits to take advantage of the periodic sprints lower in AUD/USD.

The outstanding question for me is whether the long-standing correlation between the Aussie and the S&P 500 (SPY) will reassert itself. In recent years, the Aussie has typically led the S&P 500. If so, a major correction is coming soon for the S&P 500. See the latest T2108 Update for my thoughts on the market’s short-term direction.

Be careful out there!

Full disclosure: net long Australian dollar (see caveat above!), long SSO puts