(This is an excerpt from an article I originally published on Seeking Alpha on April 14, 2013. Click here to read the entire piece.)

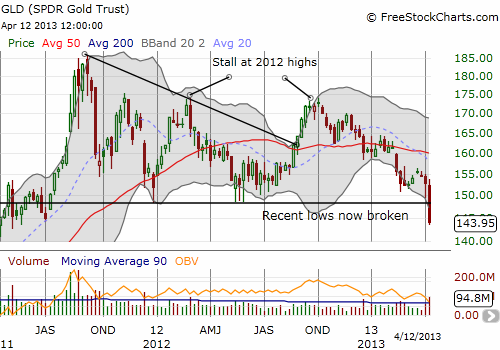

During the height of the banking crisis in Cyprus, I figured gold (GLD) would be a good trade. That lasted for all of a few days. {snip}

I have seen some articles try to explain this breakdown as a reaction to the potential of Cyprus selling gold reserves to help fund its banking bailout. {snip} If there is anything the rolling panics over the eurozone have taught us, it is that sell-offs generate buying opportunities. Gold is no different. Serious gold investors know that these acts of desperation of forced selling will literally be golden opportunities, the long awaited big dip to provide a chance to add to holdings at much better prices.

{snip}

Source for charts: FreeStockCharts.com

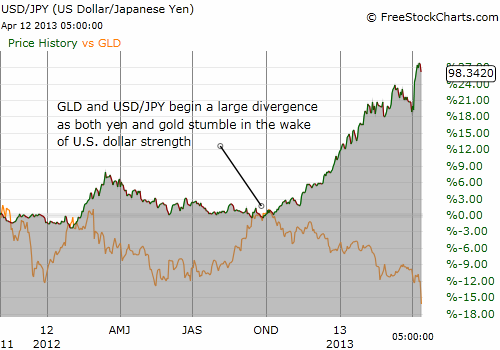

Seeing this chart suggests that the gold sell-off has little to do with deflation fears and a lot more to do with relative shifting of preferences in currencies. {snip}

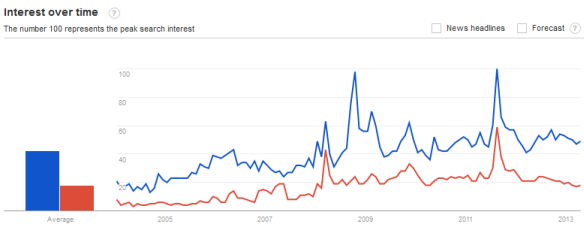

A third and final reason a bottom for gold will likely prove elusive is seen in my old “gold enthusiasm index.” {snip}

Source: Yahoo!Finance for GLD prices, Google Trends for “buy gold”

Combine the lackluster sentiment toward gold with the search index for “buy gold” and “sell gold”, and I sense a general disinterest in gold either way.

Source: Google Trends

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 14, 2013. Click here to read the entire piece.)

Full disclosure: long GLD, GG, and SLV