(This is an excerpt from an article I originally published on Seeking Alpha on April 9, 2013. Click here to read the entire piece.)

TRI Pointe Homes (TPH) is a 4-year old company based in Irvine, California that on January 31, 2013 became the first homebuilder to go IPO since 2004. The Starwood Fund, managed by an affiliate of Starwood Capital Group, beneficially owns 37.9% of TPH common stock (as of March 7, 2013). The management team beneficially owns 5.9% of TPH common stock. Parts of TPH’s management team founded the company and have worked together for 20 years. The company’s start in the middle of the recession means that it has no “legacy issues” that burden the company with distressed properties or liabilities. TPH has thus been able to completely focus target its business in areas of economic recovery. (Information in this piece is pulled together from a combination of the latest earnings report, the 10K, and the earnings conference call).

{snip}

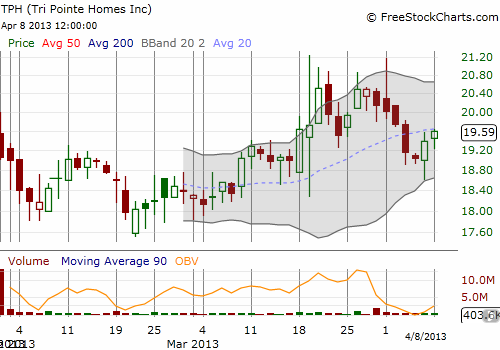

Overall, TPH looks like a great option for making a concentrated bet on the recovering California housing market, perhaps even better than Kb Home (KBH). TPH is now on my radar, and, like all the homebuilders I identified as plays for 2013, I will be targeting significant dips for returning to these stocks. I am still waiting… (next up, I am long overdue for a review of homebuilder margins so far).

Finally, I have pasted below the IPO lock-up info for TPH. While I doubt expiration will deliver a significant dip in the share price, I think it is still worth keeping this info handy for reference just in case it becomes material. From the 10K:

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 9, 2013. Click here to read the entire piece.)

Full disclosure: no positions