(This is an excerpt from an article I originally published on Seeking Alpha on April 4, 2013. Click here to read the entire piece.)

For many months, the Reserve Bank of Australia has been rolling out the same story of a peak in commodity prices, resource investment, and terms of trade. This month’s monetary policy statement seemed to be more of the same except for ONE seemingly small twist (emphasize mine):

“Global growth is forecast to be a little below average for a time, but the downside risks appear to be reduced.”

Compare this to March’s statement (emphasis mine):

“Global growth is forecast to be a little below average for a time, but the downside risks appear to have lessened over recent months.“

I may be over-thinking the difference, but to me, April’s statement represents a definitive conclusion that CURRENT conditions contain reduced economic risks. {snip}

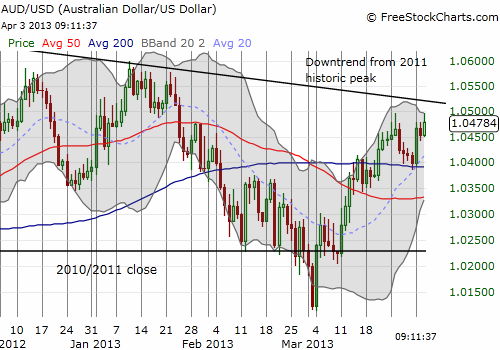

So, the slight change of wording in the first sentence of the statement is important in that it could be a precursor to other upside adjustments in the RBA’s language. If this happens, the Australian dollar (FXA) could take off…exactly what the RBA does not want. In fact, its desire to contain the currency must underlie the strained attempts to contain enthusiasm over the economy.

{snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 4, 2013. Click here to read the entire piece.)

Full disclosure: net short Australian dollar