(This is an excerpt from an article I originally published on Seeking Alpha on April 5, 2013. Click here to read the entire piece.)

{snip}

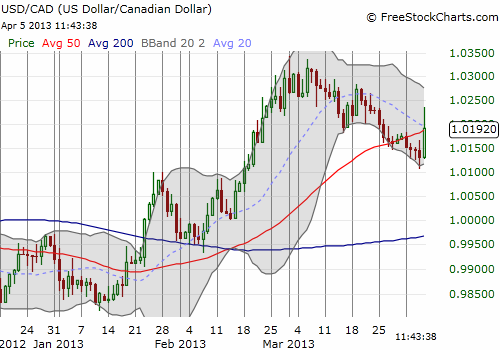

This decline in USD/CAD abruptly ended today with a very poor Canadian employment report that was well below expectations. The unemployment rate ticked up from 7.0 to 7.2% as the economy shed 54,500 jobs whereas consensus expected an additional 6,500 jobs. The U.S. employment report was little better, but expectations remain higher for the Canadian economy. At the time of writing, USD/CAD is fading back to the 50DMA which now happens to converge with the 20DMA.

Source: FreeStockCharts.com

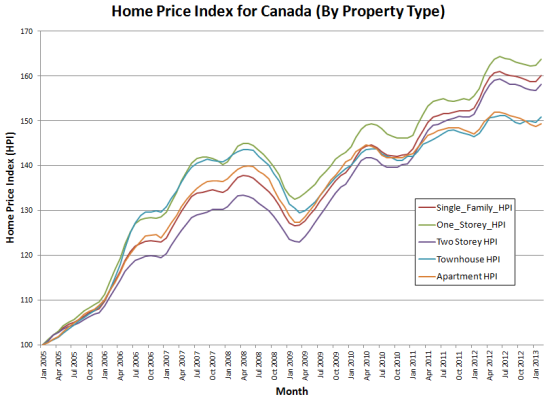

This overall pullback strikes me as a decent opportunity to reload on USD/CAD longs. The poor employment report brings Canadian real estate back in focus. Any further weakening in the labor market will only add to the growing nervousness amongst Canadians about their still robust housing market.

{snip}

Source: MLS Housing Price Index (HPI) from the Canadian Real Estate Association

According to a recent Royal Bank of Canada (RY) survey, the housing market’s levitation is starting to unnerve some people. {snip}

This wariness combined with ambivalence was further highlighted in a recent article in Globe and Mail…{snip}

Mapping all this back to the currency markets, the ambivalence maps nicely to the range within which USD/CAD has bounced for almost four years. For now, I am still betting that, eventually, this range will get broken to the upside and consider dips to be buying opportunities.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 5, 2013. Click here to read the entire piece.)

Full disclosure: no positions