(This is an excerpt from an article I originally published on Seeking Alpha on March 28, 2013. Click here to read the entire piece.)

The Office of the Comptroller of the Currency (OCC) just released its report on mortgage performance for the fourth quarter of 2012. It is a story of mortgages that continue to mend within the on-going economic and housing recovery.

The overall good news is that the vast majority of “first-lien mortgages serviced by large national and federal savings banks” remain current and performing:… {snip}

These numbers are consistent with Lender Processing Services’s (LPS) Mortgage Monitor report from January showing a steady decline in new problem loans in both judicial and non-judicial states since 2009. {snip}

{snip}

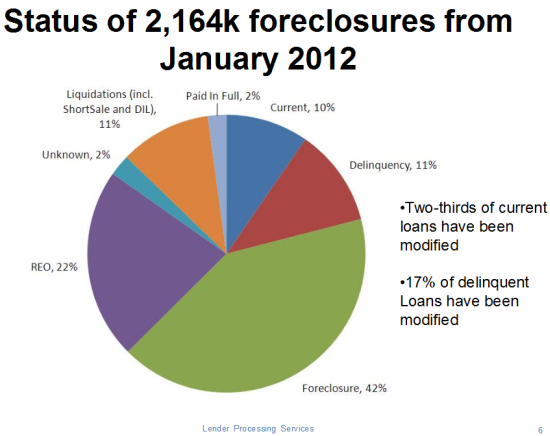

LPS provides a breakdown of what has happened to homes that were in foreclosure in January, 2012. Note that 42% of them remain stuck in the foreclosure process.

Source: Lender Processing Services January, 2013 Mortgage Monitor Report

These mortgage add to the evidence of a housing recovery and a likely sustainable bottom. However, this recovery is still in the early stages almost 8 years since the peak and 6 years since the housing bubble’s unwind really picked up speed. According to LPS data, delinquencies held steady between 4 and 5% of active loans from 1995 to 2005. The foreclosure rate was also relatively steady over this period at a paltry 0.44% of active loans. The housing recovery still has a long road to travel.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 28, 2013. Click here to read the entire piece.)

Full disclosure: no positions