(This is an excerpt from an article I originally published on Seeking Alpha on March 4, 2013. Click here to read the entire piece.)

In its latest statement on monetary policy, the Reserve Bank of Australia (RBA) said nothing new. The RBA left rates unchanged at 3% while at the same time making it clear that the inflation outlook leaves it with plenty of “scope to ease policy further” if needed. The economic outlook remains anemic but downside risks are apparently diminishing. It was another not great, but not too bad statement.

{snip}

{snip}

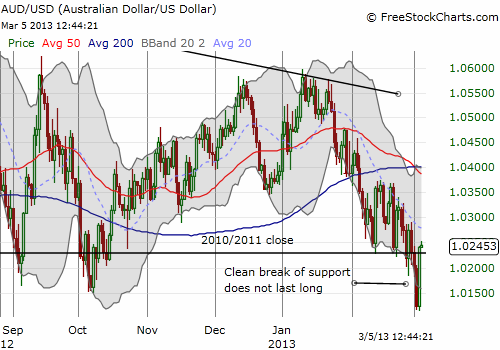

Last month, the RBA described in more detail than usual the link between monetary policy and the exchange rate, clarifying that the exchange rate is not targeted but excessively high levels can create economic conditions conducive toward lowering rates. In the latest statement, the RBA once again showed no alarm regarding the high rate but reminded markets that the rate is too high. Typically, the RBA expresses this relative to terms of trade that have past their peak. This time, the RBA added a little twist referring explicitly to export prices and referencing low credit demand as a bonus:

“…the exchange rate remains higher than might have been expected, given the observed decline in export prices, and the demand for credit is low, as some households and firms continue to seek lower debt levels.”

{snip}

Source: Reserve Bank of Australia

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 4, 2013. Click here to read the entire piece.)

Full disclosure: short AUD/USD