This is an excerpt from an article I originally published on Seeking Alpha on February 4, 2013. Click here to read the entire piece.)

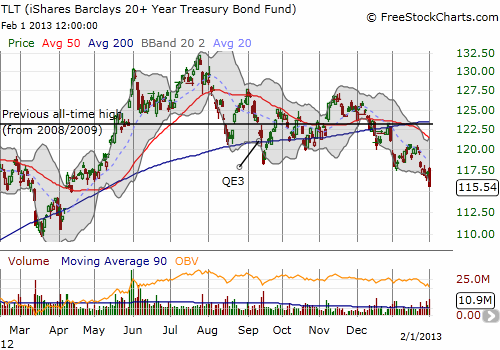

Long-term interest rates are moving higher. Although it can be difficult to interpret the meaning of interest rate movements given the Federal Reserve is an active player in manipulating rates, I am guessing a large part of the current move comes from an ever increasing confidence in the American economic recovery. iShares Barclays 20+ Year Treasury Bond Fund (TLT), whose price moves inverse to yields, has traded to nine-month lows in a continuation of a breakdown that really began in fits and starts when the Federal Reserve announced another round of quantitative easing (QE3) last September.

Source: FreeStockCharts.com

{snip}

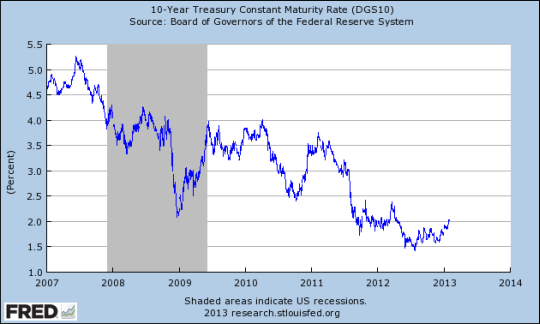

Source: Federal Reserve Bank of St. Louis

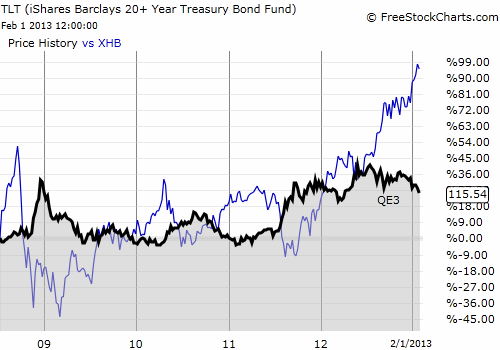

So while QE3 has succeeded in goosing the S&P 500 (SPY) to 5-year highs and closer and closer to all-time highs, it is failing to drive rates lower as advertised. {snip}

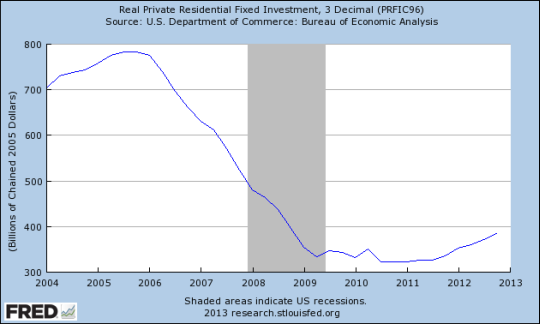

Higher rates could be a mixed bag for housing. {snip}

So far, interest rates have not seeped into the narrative around the continued stream of strong data points for the housing recovery. Here are some of the recent highlights:

{snip}

Source: Federal Reserve Bank of St. Louis

In total, I do not see the current bump up in interest rates placing a dent in strong data points like the ones above. {snip}

Source: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on February 4, 2013. Click here to read the entire piece.)

Full disclosure: long TLT puts, TBT shares