This is an excerpt from an article I originally published on Seeking Alpha on January 28, 2013. Click here to read the entire piece.)

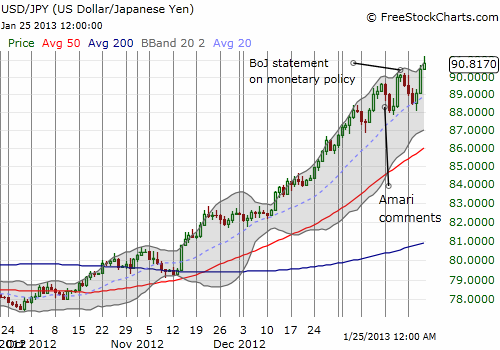

When the Bank of Japan (BoJ) announced its latest statement on monetary policy in conjunction with the Japanese government, the yen (FXY) strengthened counter to the trend over the past several months. It was very easy to explain this response as “sell the news” or disappointment with the 2014 start for open-ended asset purchases which will not achieve the 2% inflation target by next year (see “Introduction of the ‘Price Stability Target’ and the ‘Open-Ended Asset Purchasing Method’“).

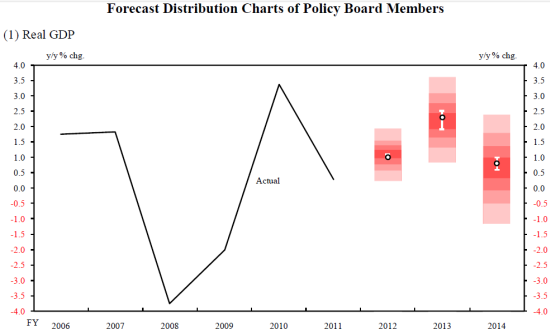

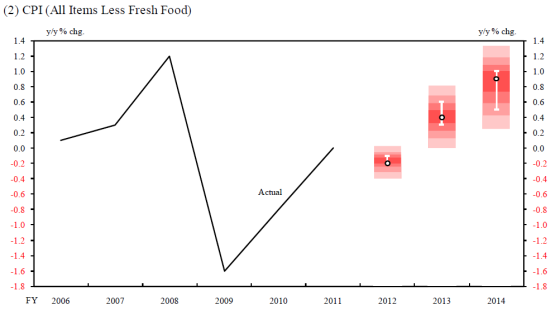

Through 2014, the forecasts for inflation and GDP growth are indeed quite modest. From the statement (the shading shows the distribution of the forecasts and the circles show the median of the forecasts):

Source: Bank of Japan, “Introduction of the ‘Price Stability Target’ and the ‘Open-Ended Asset Purchasing Method’“

{snip}

Source: FreeStockCharts.com

{snip}

Similarly, the market may have missed the point in the BoJ announcements and forecasts that they leave the door open for even more aggressive steps to get inflation to 2% by next year. This is a particularly intriguing possibility if the Japanese government gets impatient with the trajectory and progress with inflation. {snip}

The international reaction to Japan’s road to inflation has of course been greeted with displeasure in key corners of the world. {snip}

These echoes of currency wars will likely get bigger visibility in the next G20 meeting. The world has become accustomed to the steady strengthening bias in the yen for so many years; the reverse is proving more and more unsettling.

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on January 28, 2013. Click here to read the entire piece.)

Full disclosure: no positions