This is an excerpt from an article I originally published on Seeking Alpha on January 21, 2013. Click here to read the entire piece.)

The negative news cycle has begun again on Monster Beverage Corporation (MNST), and it is creating fresh trading opportunities.

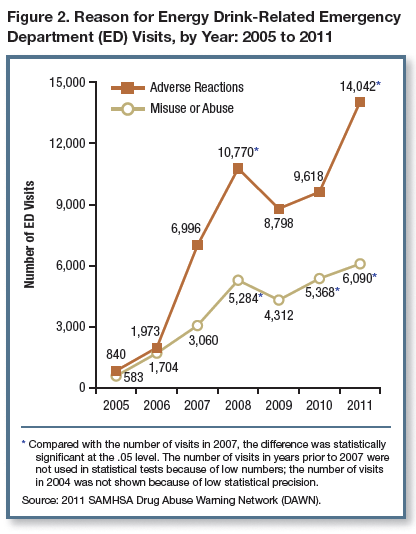

On January 10th, the Drug Abuse Warning Network (DAWN), “a public health surveillance system that monitors drug-related morbidity and mortality” run by the Substance Abuse and Mental Health services Administration (SAMHSA) through the Federal Department of Health and Human Services, produced a report titled “The DAWN Report: Update on Emergency Department Visits Involving Energy Drinks: A Continuing Public Health Concern.” This report updated a similar report from November 22, 2011 and included several citations of related research. They key finding is expressed simply in the chart below.

{snip}

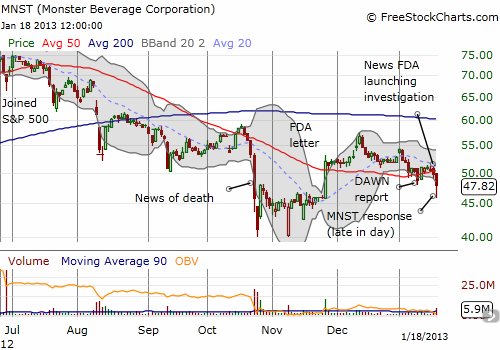

On the day of the release, MNST dropped 3.1% on average volume. All these losses were reversed the next day and the stock proceeded to drift along its 50-day moving average (DMA). This relief was disturbed on January 17th when Representative Edward J. Markey and Senators Richard J. Durbin and Richard Blumenthal published an ominous letter…{snip}

{snip}

However, on January 18th, vague rumors about a short-seller active in MNST shares (according to briefing.com) restoked headline fears and uncorked more selling pressure. {snip}

{snip}

In other words, the strongest conclusion one can make from the DAWN report is that perhaps there is an alarming change in consumption behavior of caffeinated drinks and not that energy drinks themselves have suddenly become more dangerous. If any subsequent rulings from the FDA get applied to MNST, they will need to be applied to coffee as well, not very likely.

When I first saw MNST’s stock plunging, my reflexes sent me to MNST options for trading clues before selling puts into the heightened anxiety. {snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on January 21, 2013. Click here to read the entire piece.)

Full disclosure: no positions