This is an excerpt from an article I originally published on Seeking Alpha on February 1, 2013. Click here to read the entire piece.)

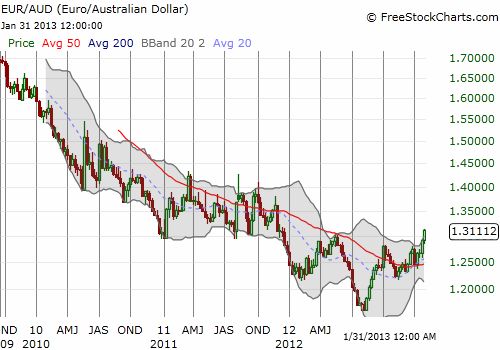

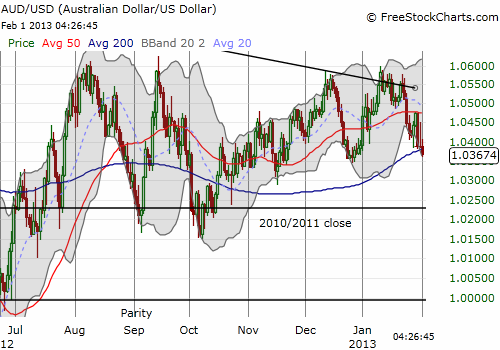

While all eyes are trained on U.S. economic data this week, Australians are looking ahead to Monday, February 4th when the Reserve Bank of Australia (RBA) makes its next statement on monetary policy. Consensus forecasts pin rates right where they stand at 3.0%. Yet, the Australian dollar (FXA) has traded steadily downward against all major currencies except the Japanese yen (FXY) going into this meeting as if the odds are relatively high that the RBA will cut rates yet again.

{snip}

{snip}

{snip}

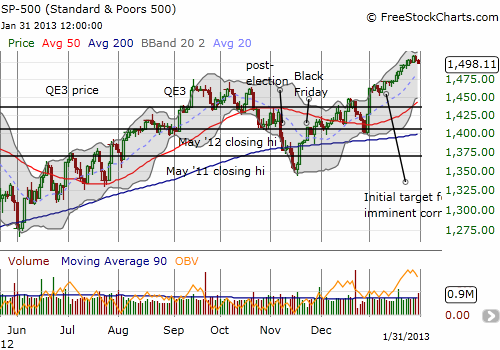

…This means the typically strong correlation between the Australian dollar and the S&P 500 is once again broken. In fact, this correlation has trended downward over the past year or so as the Australian dollar has failed to make further gains as the S&P 500 has churned higher {snip}… I strongly expect that the current weakness in the Australian dollar is providing the same early signal it did in 2012. The RBA may hold the final key.

{snip}

Even if the Australian dollar rebounds after the RBA announcement, I think the overall downtrend will soon reassert itself. {snip}

Source for charts: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on February 1, 2013. Click here to read the entire piece.)

Full disclosure: long SSO puts