(This is an excerpt from an article I originally published on Seeking Alpha on January 21, 2013. Click here to read the entire piece.)

On January 17th, NPR’s All Things Considered ran a story called “Homebuilding Is Booming, But Skilled Workers Are Scarce.” It was yet another story adding to the evidence that the tightness of the market for construction labor is increasingly weighing on the outlook for homebuilders (I last directly addressed this four months ago in “Shortage of Labor in Some Housing Markets“). There were some very choice quotes in this piece that motivated me to dig one more layer deeper into the data.

{snip}

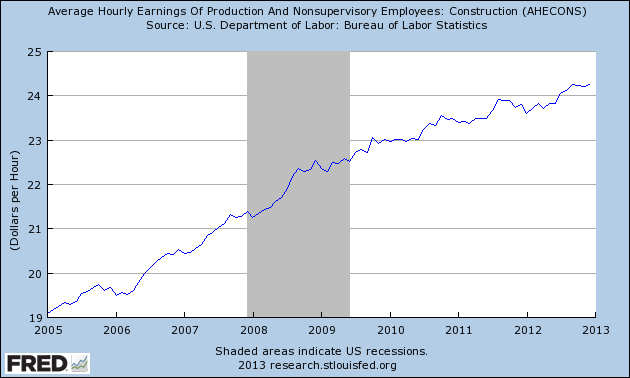

Source for chart: St. Louis Federal Reserve

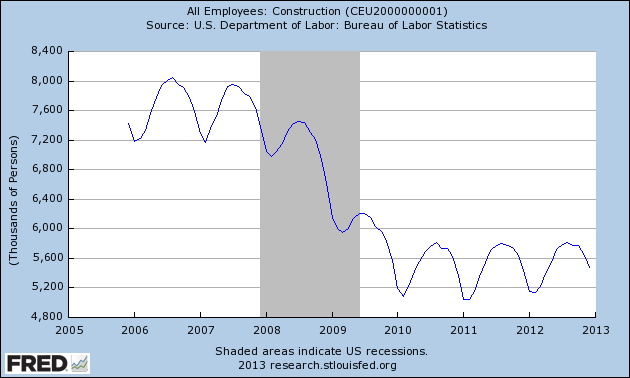

Source for chart: St. Louis Federal Reserve

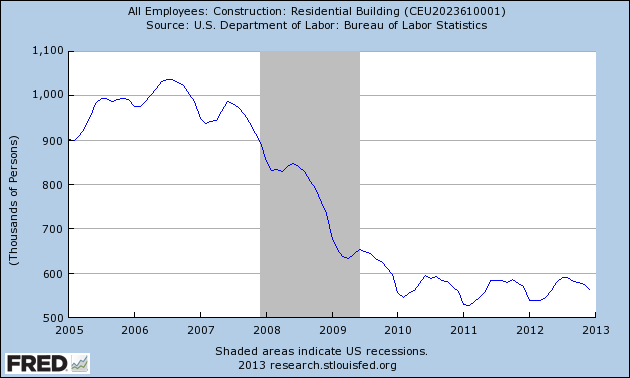

Source for chart: St. Louis Federal Reserve

…{snip} 60% of applicants do not pass drug tests and background checks…

{snip}

The article states generically that many construction workers have returned to their home countries. Mexican migrants represent some large proportion of that number… {snip}

Given the mix of factors driving net migration toward zero, it is far from clear how easily this flow can or will reverse anytime soon. {snip}

Overall, it appears that the tightening labor conditions in the housing market will not ease quickly or readily. {snip}

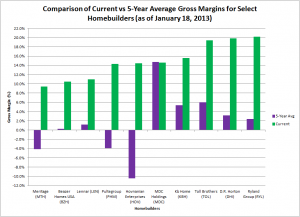

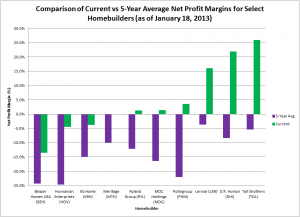

The charts below compare gross and net profit margins across various homebuilders including current values versus 5-year averages. {snip}

Click images for larger views…

All data from MSN Money (profit margins)

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 21, 2013. Click here to read the entire piece.)

Full disclosure: no positions