(This is an excerpt from an article I originally published on Seeking Alpha on December 31, 2013. Click here to read the entire piece.)

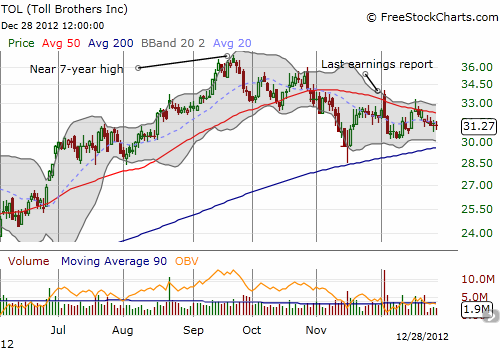

On Friday, December 28, 2012, Nightly Business Report interviewed Martin Connor, the CFO of luxury homebuilder Toll Brothers (TOL). I am on the lookout for 2013 guidance from homebuilders, so this interview caught my attention with regard to expectations for future pricing and the composition of demand. While TOL was able to raise prices “modestly” in about half its communities in 2012, Connor sounded somewhat unsure about the ability to raise prices in 2013:

{snip}

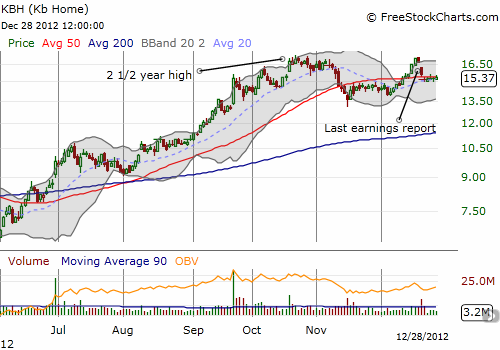

In its latest earnings conference call on December 20, 2012, Kb Home (KBH) did not provide direct guidance on 2013 pricing, but the company seemed to suggest that the higher prices it should see in 2013 will be a result of deals locked in 2012. {snip}

This lack of definitiveness is important. As the housing market continues to recover, attention will focus ever more intently on margins and the sustainability of demand. {snip}

Connor foresees a good possibility for costs continuing to rise. {snip}

Homebuilders have been able to wield a little more pricing power because of the on-going influence of more affluent buyers, the homebuyers who have good enough credit to overcome the current high hurdles in underwriting. {snip}

KBH has seen success by refocusing its business on some of the hottest markets in the U.S. where first-time homebuyers have solid jobs and earn strong incomes. {snip}

Even if the higher-income market remains robust in 2013 and beyond, ultimately, the prosperity needs to broaden and diversify for the housing recovery to sustain its momentum. McMansions cannot carry the entire market. KBH recognizes this:

{snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 31, 2013. Click here to read the entire piece.)

Full disclosure: no positions