(This is an excerpt from an article I originally published on Seeking Alpha on December 24, 2012. Click here to read the entire piece.)

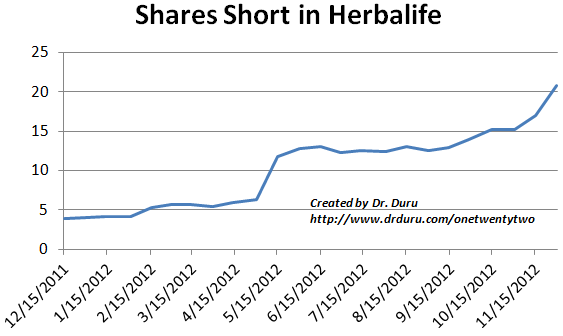

So it turns out that Bill Ackman, with his hedge fund Pershing Square Capital Management, is the “big whale” behind the massive short position built against Herbalife (HLF). Ackman indicated that he has shorted more than 20M shares with over $1B at risk. {snip}

Source: NASDAQ.com short interest

In stark contrast to the growing short position, 21% of HLF’s float, HLF’s stock stood firm, even increasing for a while, during both ramps in short interest. Throw in $3.1M of insider purchases in November by Herbalife COO Richard Goudis, and I figured HLF was good for a small buy. I now recognize this as a tactical error given the main rumor had yet to get resolved: a surge in put buying aimed at profiting from some big event before the December 21st expiration. {snip}

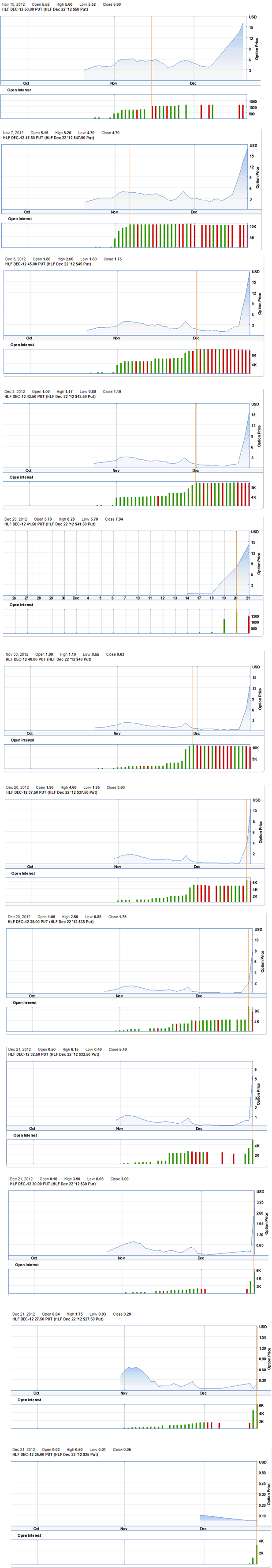

Throughout November, traders ramped up purchases of December puts. The targeting is quite clear given the periodic and limited surges in open interest in select strikes. {snip}

Source: Etrade.com

{snip}

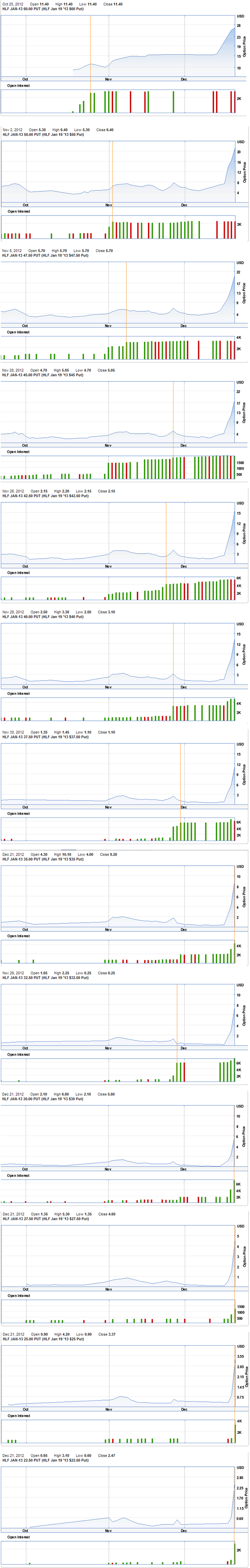

During November, December puts were not the only ones seeing action. Traders also loaded up puts with January expiration. {snip}

Source: Etrade.com

{snip}

Source: Etrade.com

{snip}

The volume of trading on Friday, December 21st suggests that traders remain as bearish as ever for January but after that there could be a lot more ambivalence. {snip}

With Herbalife set to conduct an analyst day conference on January 7, 2013 to answer the charges against the company, I am willing to hear them out and get their side of this story. If the COO’s massive purchase of stock means anything, I have to assume he will be working hard to support the success of that presentation. The market’s response going into and out from that meeting should be quite telling. For now, I am holding onto my small amount shares, and I even sold a February put into Friday’s plunge with the assumption that at some point HLF will experience a relatively large relief rally. Friday delivered a third straight day of high-volume selling with the stock reaching extremely oversold conditions; frequently such selling is followed by a sharp bounce.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 24, 2012. Click here to read the entire piece.)

Full disclosure: long HLF