(This is an excerpt from an article I originally published on Seeking Alpha on January 4, 2013. Click here to read the entire piece.)

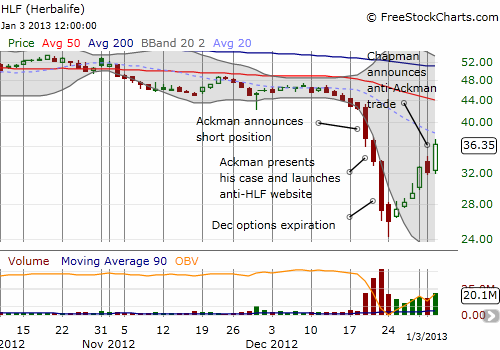

{snip} This reversal was punctuated by Chapman Capital’s Robert Chapman revelations on January 3rd that he bought HLF on the cheap to trade directly against Ackman.

Source: FreeStockCharts.com

Herb Greenberg of CNBC got the interview with Chapman on Thursday, January 3rd. Greenberg next discussed his interview with the CNBC crew.

While Greenberg is a skeptic of Chapman’s trading thesis and a skeptic of HLF, I am fascinated by Chapman’s approach. Just as Ackman saw an opportunity to go after a company vulnerable to his charges and media hype, Chapman now sees an opportunity to do the same to Ackman. So far, it is succeeding.

On December 29th, Chapman wrote a letter to his investors titled “Herbalife: Why I Made It a 35% Position after the Bill Ackman Bear Raid” (Greenberg linked to it in his article on CNBC). I highly recommend you read it before you consider trying to ride the coattails of either Ackman or Chapman. Chapman matches Ackman’s brilliance here. {snip}

I will not review Ackman’s rebuttal, especially since HLF will provide its own next week. Instead, I am more focused on Chapman’s valuation estimation and price targets. {snip}

Chapman provides a primer on short-selling describing how Ackman has put his fund at serious risk with the tremendous size of his position. {snip}

{snip} Here are the highlights I have picked up from the options trading in HLF {snip}

What sticks out of course is that the daily trading was much more bullish than open interest EXCEPT for the May expiration. {snip}

The very bullish trading in options expiring next week is quite telling. {snip}

Overall, the generally bullish tone in the options trading continues the very steep downward trend in the open interest put/call ratio that began after Ackman’s presentation. {snip}

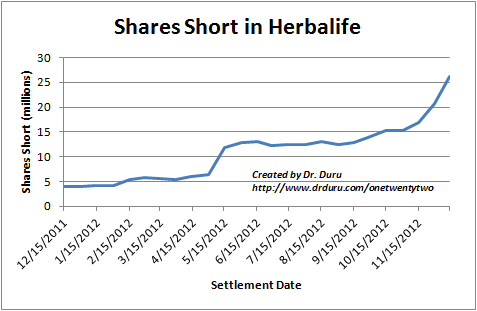

HLF has now turned into an epic battle of giants. {snip}

Source: NASDAQ.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 4, 2013. Click here to read the entire piece.)

Full disclosure: long HLF and short HLF puts