(This is an excerpt from an article I originally published on Seeking Alpha on December 19, 2012. Click here to read the entire piece.)

For over two years, Marvell Technology Group Ltd (MRVL) has repurchased a LOT of shares.

{snip}

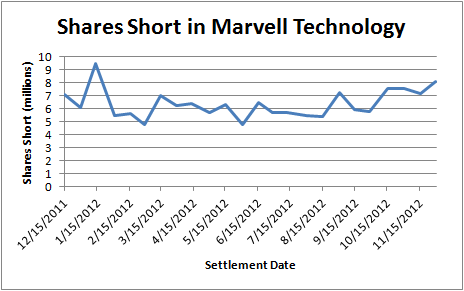

Indeed, even after spending $2.1B repurchasing shares, MRVL still has $2B sitting on the balance sheet in the form of cash, cash equivalents, and short-term investments. Cash flow generation is strong. Yet, despite the company’s continued generosity toward shareholders, the stock has been trading at early 2009 levels for over the past two months. {snip} Even shorts are unimpressed. {snip}

Source: NASDAQ.com short interest

So a natural question might be to ponder whether MRVL is just a value trap, like Hewlett Packard (HPQ). {snip}

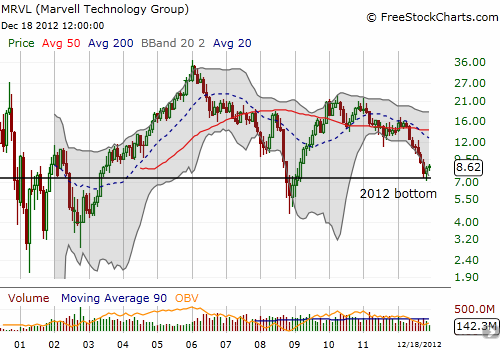

Finally, the stock chart in MRVL is showing some encouraging signs for the first time in a long time. {snip}

As always, time will soon tell. But for now, MRVL looks like a good risk/reward play at current levels.

This monthly chart is a cautionary reminder of the longer-term challenges MRVL has faced with a business so heavily reliant on PCs:

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 19, 2012. Click here to read the entire piece.)

Full disclosure: long MRVL