(This is an excerpt from an article I originally published on Seeking Alpha on December 6, 2012. Click here to read the entire piece.)

On Monday, November 3, Bloomberg reported that Credit Suisse Group AG (CS) will soon charge negative interest rates on cash balances denoted in Swiss francs (FXF). Francs are increasingly becoming trash as the cost of servicing large cash balances is not worth the minimal revenue banks can earn from them.

{snip}

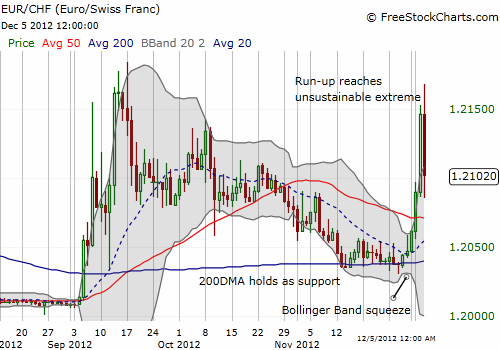

There are several features of the chart which carry good lessons for trading currencies. The first notable feature is how extremes are not long tolerated. When EUR/CHF first came to life again in early September, the currency pair ran up quickly but on an intra-day basis it could not long hold moves above the upper Bollinger Band (BB). The BB is defined by the grey area and loosely defines a range of expected volatility.

{snip}

CS’s statement on its negative rates makes it very clear that the bank wants to reduce the size of franc balances (emphasis mine):

{snip}

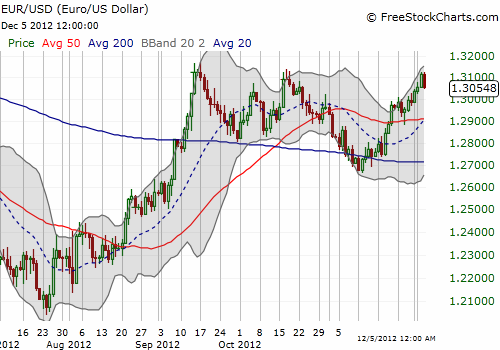

When I first noted a revival in trading in EUR/CHF in early September, I claimed that it was supportive of a stronger euro (FXE) going forward. This is indeed what has happened…{snip}

{snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 6, 2012. Click here to read the entire piece.)

Full disclosure: no positions