(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2012. Click here to read the entire piece.)

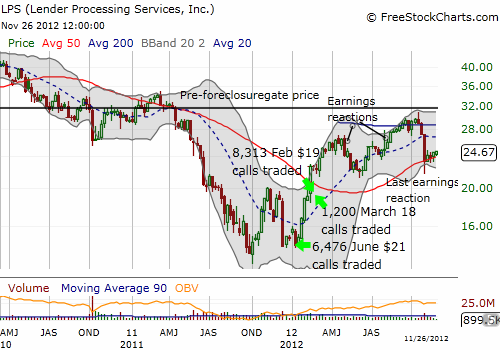

I have followed Lender Processing Services (LPS) for a little over two years. It all started soon after LPS sold off swiftly in the wake of disclosures regarding “foreclosuregate” in late September, 2010. At the time, I noticed that options traders were well ahead of the game by loading up on puts ahead of the news. {snip}

The post-earnings sell-off lasted for two brutal, high-volume days with the stock finally bottoming at $21.68 – a 21% post-earnings loss. The sharp rebound that day has all the look of a wash-out of sellers even though high-volume selling temporarily returned the following day. {snip}

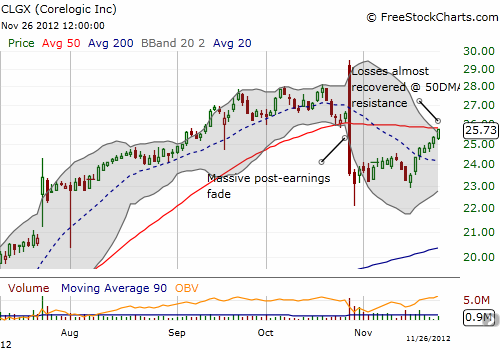

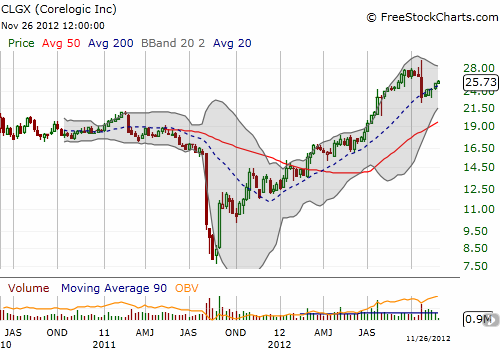

With no smoking gun coming form the earnings report, I looked at the market’s reaction to earlier earnings from CoreLogic, Inc (CLGX). {snip} Given this trading action, I have to conclude that what happened was mostly profit-taking.

Source for charts: FreeStockCharts.com

{snip}

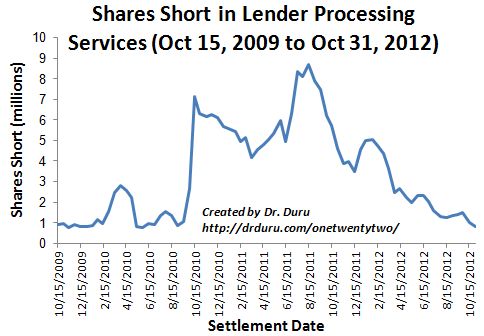

Finally, note that shares short in LPS dropped to its lowest level in over two years just ahead of earnings. {snip}

Source: NASDAQ.com Short Interest

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2012. Click here to read the entire piece.)

Full disclosure: long GS