(This is an excerpt from an article I originally published on Seeking Alpha on December 12, 2012. Click here to read the entire piece.)

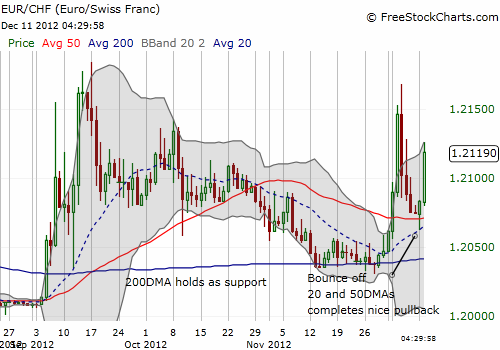

Last week I discussed trading in the Swiss franc (FXF) in the wake of Credit Suisse’s implementation of negative interest rates for large cash balances denoted in Swiss Francs (see “Cash Is Trash When Denoted In Francs“). At the time I suggested that it was time to position in the franc given the pullback had begun off extremes of a surge that started at the end of November. As it turns out, the franc is already revving up again as another statement on monetary policy looms from the Swiss National Bank (SNB).

{snip}

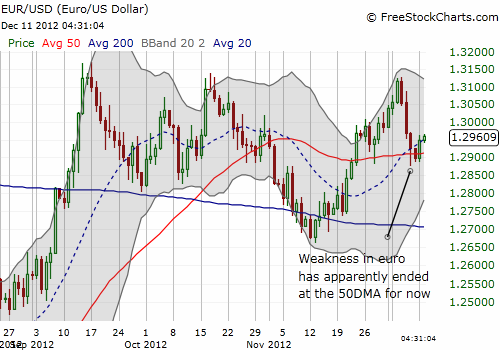

Instead of going long EUR/CHF ahead of the SNB decision (I just sold out of my position into the pop), I like buying the euro against the dollar. {snip}

The chart below shows that the EUR/USD is positioned well to bounce.

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 12, 2012. Click here to read the entire piece.)

Full disclosure: long EUR/USD