(This is an excerpt from an article I originally published on Seeking Alpha on November, 2012. Click here to read the entire piece.)

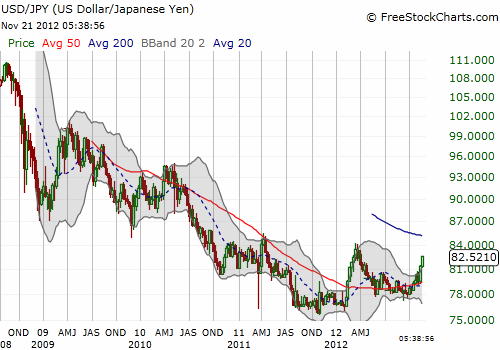

Japanese yen (FXY) traders have been here before. Earlier this year, the U.S. dollar (UUP) ripped from historic lows against the yen around 76 to a peak just above 84 in just six weeks. {snip} Fast forward to today and the Japanese economy has now logged five straight months of declines in exports (in annual terms) and a trade deficit for the fourth month in a row. {snip}

The Japanese economy appears to be heading back into recession. The likely winning party in next month’s national elections has reiterated promises to force the Bank of Japan (BoJ) to print unlimited quantities of currency to reach an inflation target of 3%. {snip}

So is this time different for the yen? It appears so.

{snip}

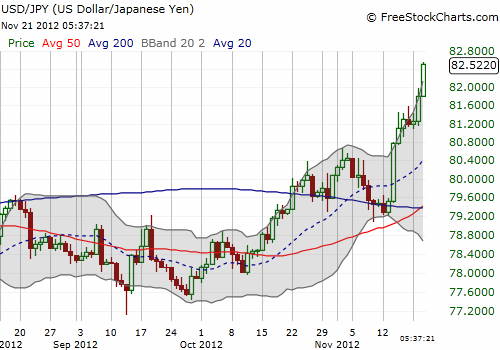

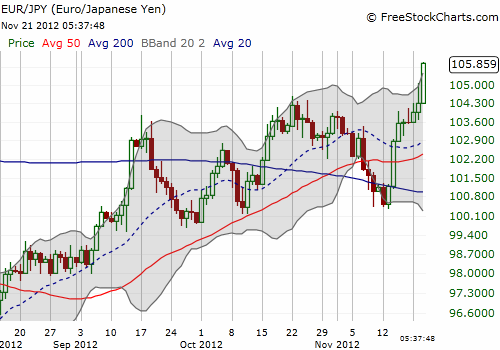

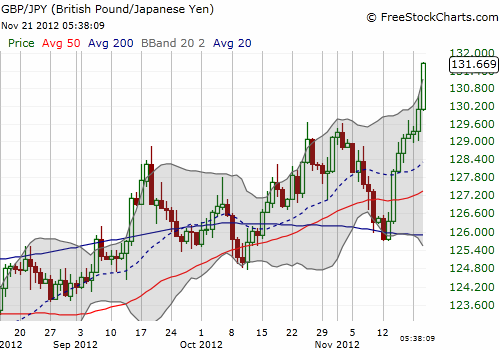

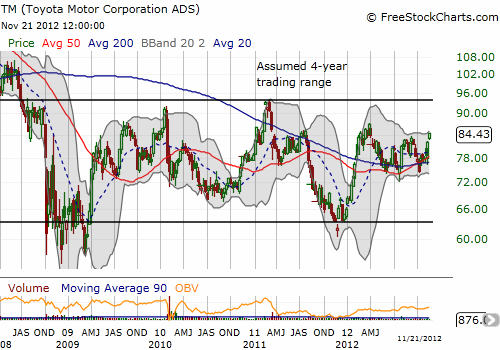

The piling on against the yen is showing up clearly in the charts as yen crosses have pressed extremes for over a week hitting the upper part of what is called the Bollinger Band which is a rough measure of the expected trading range based on recent volatility.

Given these extremes, however, one should expect a pullback at anytime. {snip}

Over the longer-term, it seems the U.S. dollar will hold a sustained advantage over the Japanese yen. {snip}

Even if next month’s election somehow generate “yen relief,” I think the increasing domestic rancor regarding the over-valued yen will sooner than later change the dynamic on the yen in a sustained way that will bias the currency toward weakness.

Finally, if the yen does continue to weaken into 2013, buying shares of Japanese exporters may continue to make sense to the extent a weaker currency can deliver a better competitive position. {snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November, 2012. Click here to read the entire piece.)

Full disclosure: no positions