This is an excerpt from an article I originally published on Seeking Alpha on October 31, 2012. Click here to read the entire piece.)

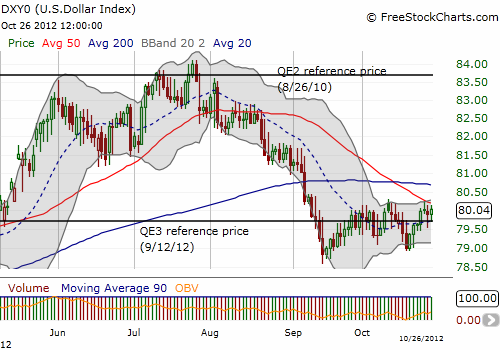

Last week’s U.S. GDP print (advance estimate, revisions to come) came in slightly stronger than expected with an annualized growth rate of 2.0%. Financial markets had relatively muted reactions. The S&P 500 (SPY) barely held support for the fourth straight day. Even the U.S. dollar index (UUP) closed flat remaining just below its 50-day moving average (DMA) as QE3 has still failed to weaken the currency.

With this lackluster backdrop, I read through the details of the GDP report. I noted that residential fixed investment – including residential construction like new single-family and multi-family houses, manufactured housing (or mobile homes) – is showing increasing momentum. {snip}

Source: FreeStockCharts.com

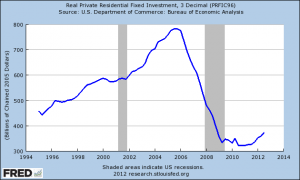

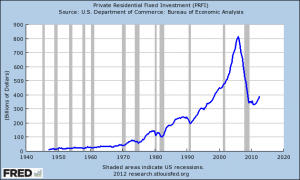

However, putting this momentum into perspective, it is clear why the economy remains sluggish. Private residential fixed investment is bouncing off historic lows.

Click graphic for larger view…

{snip}

Click graphic for larger view…

Source for charts: Federal Reserve Bank of St. Louis, Economic Research (FRED)

The long way up from here could point the way to a more robust economic recovery in coming years. {snip} I believe 2013 will be a critical year for demonstrating the sustainability of the growing demand for housing and the ability for supply to deliver at reasonable prices.

For over a year, the Economic Cycle Research Institute (ECRI) has been predicting a recession right around the corner…{snip}…if a recession finally does arrive, it will likely be self-inflicted and thus, hopefully, much easier to turn around than the last one (the aftermath of Hurricane Sandy is of course a large wildcard). Or perhaps the nascent rebound in private residential fixed investment tells us that any near-term recession will be quite mild. Time will tell.

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on October 31, 2012. Click here to read the entire piece.)

Full disclosure: no positions