(This is an excerpt from an article I originally published on Seeking Alpha on November 7, 2012. Click here to read the entire piece.)

The day before the 2012 U.S. Presidential election, the U.S. dollar (UUP) climbed above its 200-day moving average (DMA), a critical resistance that I assumed it could not crack in the near-term thanks to QE3.

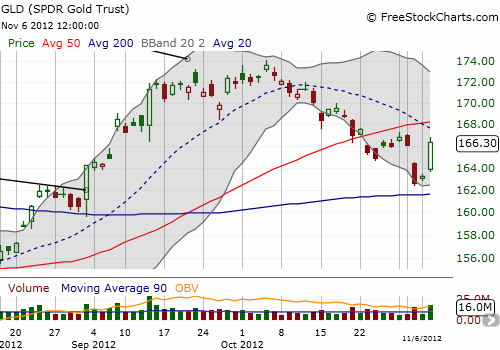

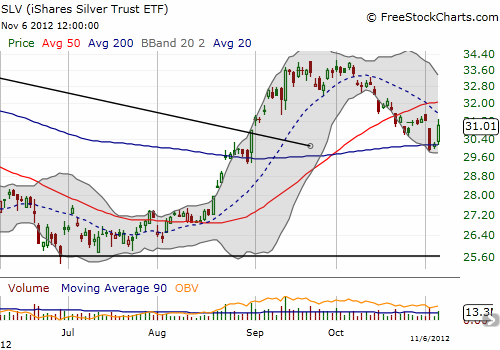

The dollar’s stubborn resilience has put a halt in the dual breakouts in gold (GLD) and silver (SLV) although both precious metals ETFs experienced impressive bounces off 200DMA support.

{snip}

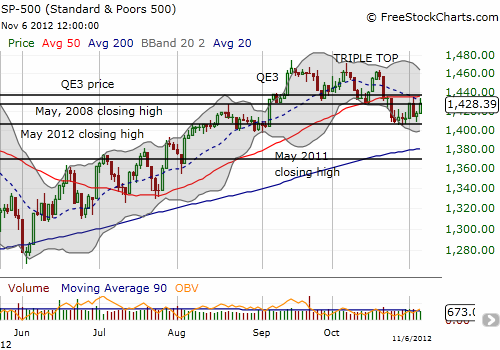

In other words, the QE3 reference price continues to loom large in the background of financial markets. So, it looks like the dollar’s vote is in and it is ready to run even higher. However, if the dollar does continue to rally from here, the time the index spent under the 200DMA resistance would be the second shortest since the dollar’s secular decline ended in 2008. {snip}

In fishing around for reasons to convert into a dollar bull despite QE3, I took another look at a chart of central bank balance sheets presented last week by Philip Lowe, Deputy Governor of the Reserve Bank of Australia in a speech titled “Australia and the World.”

Note how the Federal Reserve has suddenly become the laggard of the major central banks currently exercising some form of quantitative easing. {snip}

The resolution of the next direction for the dollar may take a lot more time. After all, it is almost two months since the Fed announced QE3, and the dollar index has not wandered far from its QE3 price either upward or downward. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 7, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, SLV