(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2012. Click here to read the entire piece.)

While expectations generally remain extremely bullish for Apple (AAPL) – {snip} – the short-term price action going into earnings does not reflect that bullishness.

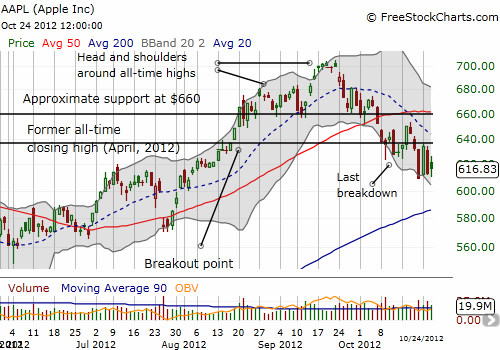

Since last printing all-time closing highs just above $700 on September 19th, AAPL has generated several bearish moves starting with a subtle head and shoulders pattern around that high. {snip}

Source: FreeStockCharts.com

Over three of the last four trading days, Apple has swung wildly with rare +/-3% one-day moves. {snip} These swings are likely a dress rehearsal for the reaction to earnings the evening of October 24th.

{snip}

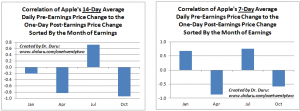

Click following charts for larger views….

{snip}

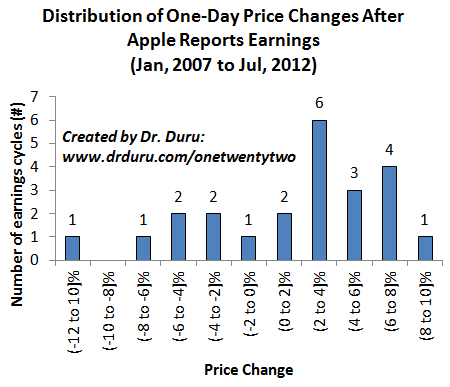

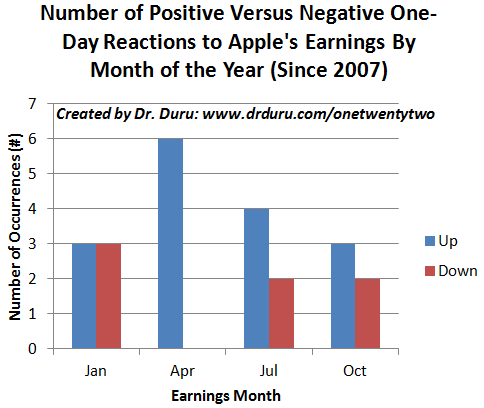

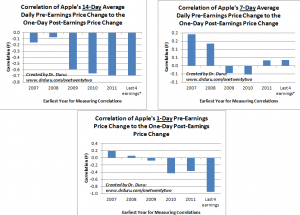

So, these data suggest that AAPL will have another favorable response albeit moderate. However, there are some extremes that make me think that the response to this October earnings cycle will deliver a large move, up OR down. {snip}

To me, these data suggest that a disappointment will plunge the stock to a steep loss even as they confirm the upside potential if AAPL delivers. {snip}

Looking at AAPL’s chart above, it seems natural to expect the stock to get bracketed by important resistance at the 50DMA around $660 and support at the 200DMA around $586. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2012. Click here to read the entire piece.)

Full disclosure: long AAPL put spreads, long AAPL calls