(This is an excerpt from an article I originally published on Seeking Alpha on September 10, 2012. Click here to read the entire piece.)

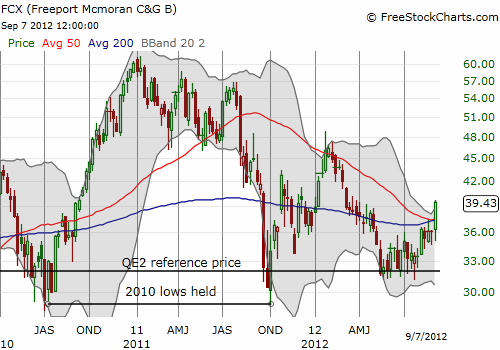

{snip}…I want to demonstrate how well last year’s playbook has worked for Freeport-McMoRan Copper & Gold Inc. (FCX) (so far!).

One of the rules from the playbook states:

“QE2 (the second round of quantitative easing) will be used as a benchmark for measuring any correction in commodities. An erasure of most or all gains from late August, 2010 will be considered a major buying signal. I will be flagging individual plays when (if) this target gets hit.”

{snip}

The first thing to note is that, as expected last year, commodity-related stocks like FCX eventually gave up all their QE2-inspired gains. What did NOT happen as expected was a crash in China that caused commodity demand to implode. So buying at the QE2 reference price has become a relatively consistent winner across a range of commodity-related stocks. In fact, I was pleasantly surprised how this one rule was sufficient for executing trades and for keeping calm during sell-offs.

{snip}

Source for charts: FreeStockCharts.com

{snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 10, 2012. Click here to read the entire piece.)

Full disclosure: long FCX