(This is an excerpt from an article I originally published on Seeking Alpha on September 4, 2012. Click here to read the entire piece.)

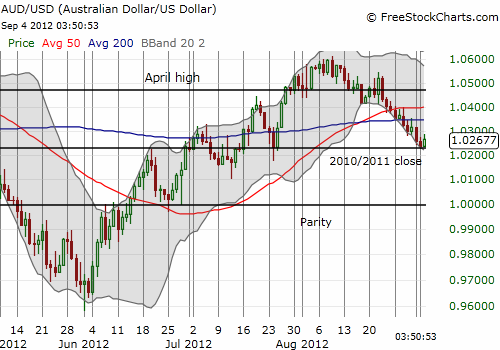

On Sunday, September 2, the Australian dollar (FXA) drifted back to flatline for the year against the U.S. dollar. This move prompted me to tweet the following:

“$AUDUSD close to flat 4 2012. Guessing should hold around here til #RBA rate decision. Bounce on no chg. Eventually restart selling #forex”

Sure enough, the Reserve Bank of Australia (RBA) left rates unchanged as expected by consensus, and the Australian dollar bounced in the immediate aftermath. How long this bounce lasts is difficult to tell given the colliding forces of flight to safety, chase for yield, and the market’s apparent assumption that Bernanke’s Jackson Hole speech further cleared the runway for imminent additional easing by the Federal Reserve.

As always, I focused on what the RBA said differently from previous statements. However, the most important aspects of this monetary policy announcement are what the RBA did NOT say:

{snip}

The RBA also showed no concern regarding the availability of funding for its banks:

{snip}

Overall, the RBA raised no significant alarms, did not attempt to jawbone its currency down, and did not signal future rate cuts. Thus, I continue to believe that future rate cuts will be primarily conditioned on events unfolding from Europe. It is not even clear to me how further rate cuts can help the Australian economy. {snip}

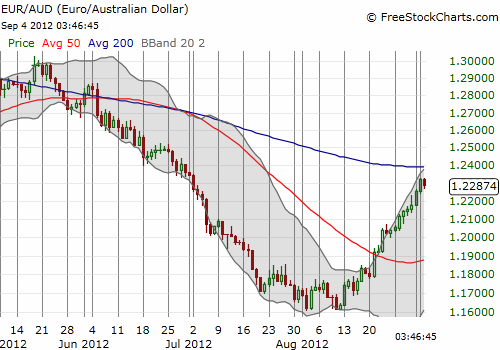

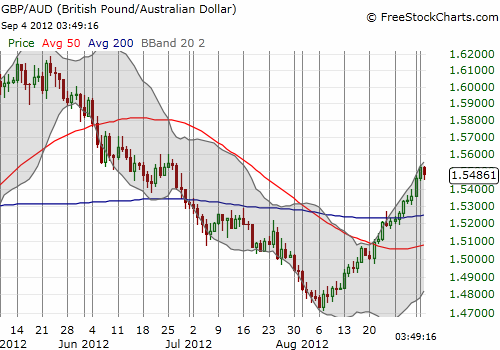

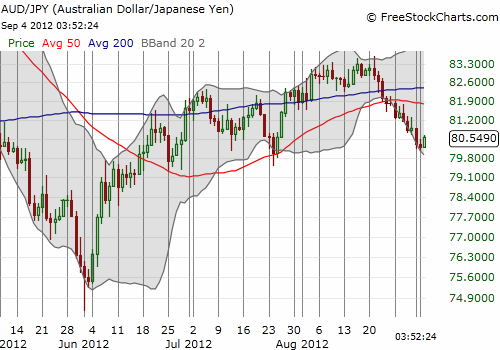

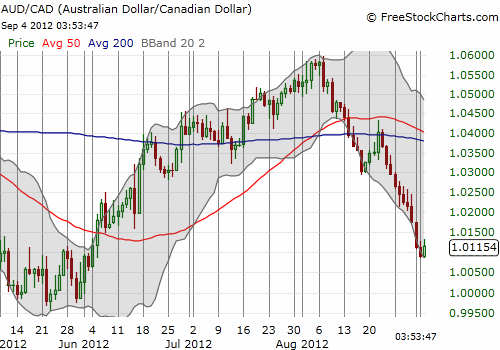

Going forward, I am marginally bearish on the Australian dollar, but I think the outlook is very different depending on the currency pair.

{snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 4, 2012. Click here to read the entire piece.)

Full disclosure: positions as stated above