(This is an excerpt from an article I originally published on Seeking Alpha on September 3, 2012. Click here to read the entire piece.)

{snip}

{snip}

First, why bother with a silver miner that is experiencing operational difficulties due to political turmoil? I think the company’s description of itself provides a good summary of the attraction for investing in PAAS (with the potential exception of the Navidad mine):

{snip}

PAAS’s 6.4M ounces of silver production last quarter was its second highest total ever. {snip}

The company remains on target to produce 24.25-25.5M ounces of silver “…at a cash cost between $11.50 and $12.50 per ounce net of byproduct credits.” Spot silver is currently priced at $31.72/ounce.

PAAS is currently valued at only $2.68B, paying a 1.1% dividend yield. PAAS started paying a dividend in 2010. The board just approved the company’s third increase since then. PAAS may further increase the dividend in another two quarters if by then the company is not able to deploy cash for working certain mines.

{snip}

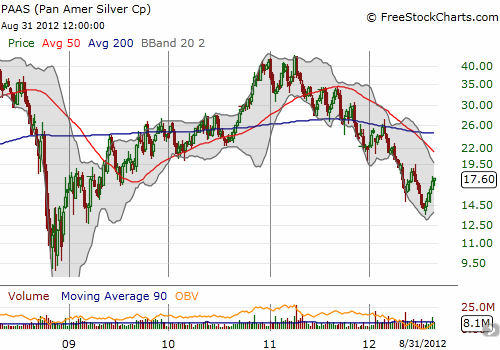

Troubles in Argentina and Bolivia have helped drive PAAS to its current low valuation.

{snip}

PAAS faced additional challenges in the second quarter. {snip}

Source: FreeStockCharts.com

Silver surged on August 31 by 3.9% as the market responded positively to Ben Bernanke’s speech at Jackson Hole. Assuming the accuracy of this interpretation for imminent easing by the Federal Reserve, the current discount on silver and PAAS are not likely to last much longer. I continue to be a buyer on the dips.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 3, 2012. Click here to read the entire piece.)

Full disclosure: long PAAS and SLV, long ZSL puts