(This is an excerpt from an article I originally published on Seeking Alpha on July 29, 2012. Click here to read the entire piece.)

{snip}

Like all companies with extensive international presence, Apple took a hit from the strong dollar (UUP)… {snip}

Apple appears to expect continued strength in the U.S. dollar as the company projects a $400M hit to revenue (net of hedges) from the currency in the current quarter. These numbers are of course small potatoes for a company that earned $35B in revenue last quarter at a growth rate of 23% year-over-year. So, Apple’s general call on macro-economic conditions is more important:

{snip}

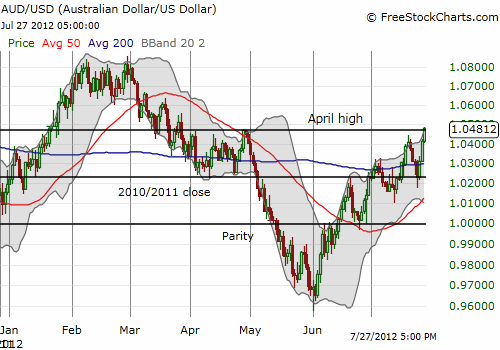

Putting aside the implication that Apple’s management claims it has no unique insight into global economic conditions, I think the choice of words is insightful. At the risk of over-interpretation, I think a prediction that conditions will not improve communicates an expectation (and hope) that conditions will stabilize. Calling out resource-based countries points to weak demand for commodities which in turn suggests little to no improvement in China. I have marveled at the strength in the Australian dollar’s bounce from June lows against the U.S. dollar (FXA) and have assumed that carry trades chasing yield are moving the currency. A stabilization in economic conditions can also explain the strong bounce.

Source for charts: FreeStockCharts.com

{snip}

The weakness in Europe did not break down as I would have expected. {snip}

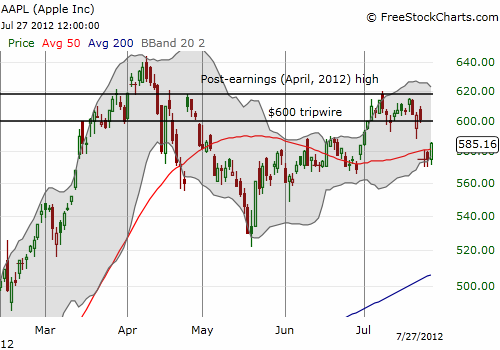

All things considered given the macro calls, I have to assume that the small setback in Apple’s stock represents a buying opportunity. {snip}

Source: FreeStockCharts.com

{snip}

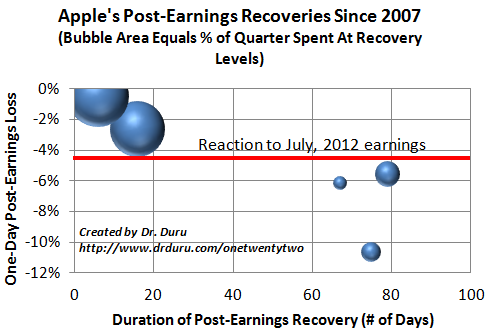

Apple’s history of recoveries from post-earnings sell-offs is consistent. {snip}

Source: Earnings dates from briefing.com, price data from Yahoo!Finance

{snip}… it seems there is about a 50/50 chance Apple will experience a short versus a long post-earnings recovery this quarter…but it WILL happen assuming history continues to matter here.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 29, 2012. Click here to read the entire piece.)

Full disclosure: no positions