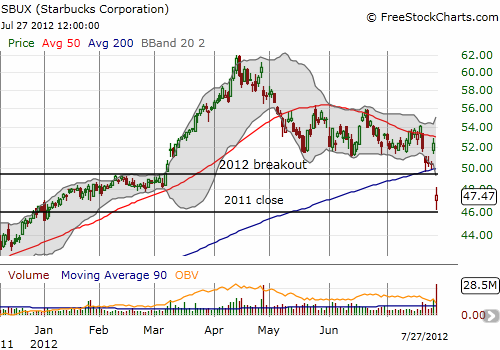

Ahead of Starbucks’ July earnings report, I warned that the stock was at a critical juncture. I concluded that Starbucks (SBUX) becomes a compelling short if it broke down through support. On Friday, SBUX broke down and at one point had erased all its gains for the year.

Source: FreeStockCharts.com

The -9.4% post-earnings performance was likely driven by disappointment in lowered guidance from SBUX:

“‘While still representing earnings growth of approximately 20% over last year’s fourth quarter, we have lowered our expectations for Q4 FY12 earnings per share to $0.44 to $0.45 to reflect the difficult economic environment all global retailers are confronting today…Nonetheless, we remain confident in the underlying strength of our business, in the strategies we have in place for driving sustained, profitable growth, and in our ability to again drive earnings growth in the range of 15% – 20% in fiscal 2013.'”

SBUX is a momentum stock that peaked a full year before the stock market peaked ahead of the last recession. SBUX recovered an amazing 786% to all-time highs from seven-year lows at the depths of 2008. This means that any miss in guidance will trigger outsized responses like Friday’s. Particularly jarring about this miss is that in the April, 2012 earnings report SBUX was VERY bullish, accelerating store openings and INCREASING earnings guidance:

“‘On the strength of our business and recent trends, we are accelerating new store growth in fiscal 2012 to approximately 1,000 net new stores globally, and raising our earnings targets for the year. With coffee cost pressures easing in the second half of the year and momentum building from investments in our growth initiatives, we are well positioned to deliver on our aggressive targets.'”

With a forward P/E of 22, SBUX is neither cheap nor expensive, so I imagine follow-through selling will not be vicious, but it should unfold slowly but surely. The best way to initiate a short would be to wait until the stock bounced upward into presumed resistance at the 200DMA and/or 2012 breakout line. Choosing long-dated puts also make sense.

Be careful out there!

Full disclosure: no positions

SBUX has a good business model and should bounce. Went long on the drop.

Careful!