The trading action in forex is starting to pick up again with quickly changing setups. Of the many twists, the Australian dollar (FXA) continues to capture a lot of my attention. Currently, the Aussie looks ready to break out against the U.S. dollar.

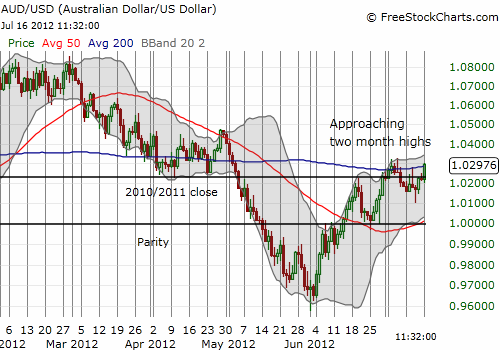

Source: FreeStockCharts.com

AUD/USD is now positive again for the year, and, at the time of writing, it is breaking above its 200-day moving average (DMA). A break to new 2-months highs would confirm a continuation of the rally from the June lows (higher highs and higher lows) and firmly position the Australian dollar in bullish territory. Such a move would also force me to re-evaluate my overall net bearish position on the Australian dollar. For now, I am hedging with very short-term long positions on AUD/USD and AUD/CHF. These positions will get longer in duration and bigger in size if (once?) the bullish position of the Aussie is confirmed. It will definitely be difficult to reconcile such bullishness with the bearish global, macro-economic environment, but I also do not like fighting the market. At some point soon, I will assemble the evidence I am hearing and reading that the Australian dollar is being driven by the carry trade. If so, this trading action has important implications for “risk-on” and “risk-off” trading days.

Be careful out there!

Full disclosure: net short Australian dollar